Rising Demand for Energy

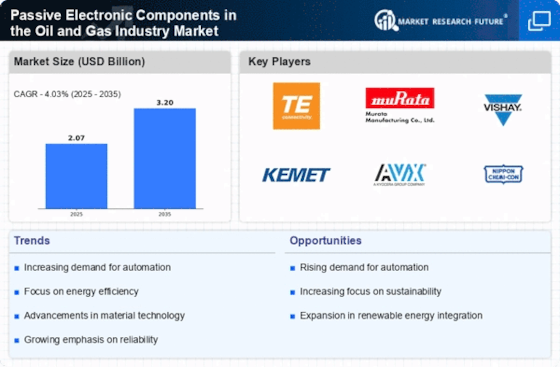

The increasing The Passive Electronic Components in the Oil and Gas Industry. As economies expand and populations grow, the need for reliable energy sources intensifies. This demand compels oil and gas companies to enhance their operational efficiency and reliability, leading to a greater reliance on passive electronic components. These components, such as capacitors and resistors, are essential for ensuring the stability and performance of various equipment used in exploration and production. According to recent data, the oil and gas sector is projected to invest significantly in upgrading infrastructure, which will likely boost the demand for passive electronic components, thereby shaping the market landscape.

Investment in Renewable Energy Sources

The transition towards renewable energy sources is influencing the Passive Electronic Components in the Oil and Gas Industry Market. As companies diversify their energy portfolios, there is a growing need for passive electronic components that can support hybrid systems. These components are essential for managing energy flow and ensuring the stability of operations that integrate both traditional and renewable energy sources. The market may experience a shift as oil and gas companies invest in technologies that facilitate this transition, potentially increasing the demand for specialized passive electronic components designed for renewable applications.

Technological Integration in Operations

The integration of advanced technologies in oil and gas operations is a significant driver for the Passive Electronic Components in the Oil and Gas Industry Market. As companies adopt automation and digital solutions, the need for reliable passive electronic components becomes paramount. These components are integral to the functioning of sensors, control systems, and communication devices that facilitate real-time monitoring and data analysis. The market is witnessing a trend where companies are increasingly investing in smart technologies, which may lead to a heightened demand for passive electronic components. This technological shift is expected to enhance operational efficiency and reduce downtime, further propelling market growth.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards play a crucial role in shaping the Passive Electronic Components in the Oil and Gas Industry Market. Governments and regulatory bodies impose stringent safety regulations to mitigate risks associated with oil and gas operations. This necessitates the use of high-quality passive electronic components that can withstand harsh environments and ensure operational safety. Companies are increasingly investing in advanced components to meet these regulations, which may lead to a surge in demand. The market is likely to see a shift towards components that not only comply with safety standards but also enhance the overall reliability of oil and gas operations.

Emerging Markets and Exploration Activities

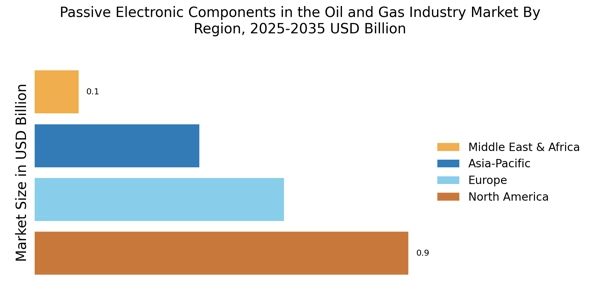

Emerging markets and increased exploration activities are driving the Passive Electronic Components in the Oil and Gas Industry Market. As companies seek new reserves in untapped regions, the demand for reliable and durable passive electronic components rises. These components are critical for equipment used in exploration and drilling operations, where environmental conditions can be challenging. The market is likely to benefit from the expansion of exploration activities in regions with rich oil and gas reserves, as companies prioritize the procurement of high-quality components to ensure operational success. This trend may lead to increased investments in passive electronic components, shaping the future of the market.