Growth in Automotive Applications

The Global Digital Signal Processor (DSP) Market Industry is witnessing a surge in demand from the automotive sector, particularly with the rise of advanced driver-assistance systems (ADAS) and autonomous vehicles. DSPs play a crucial role in processing sensor data, enabling features such as collision avoidance and lane-keeping assistance. As automotive manufacturers increasingly adopt these technologies, the DSP market is likely to benefit from this trend. The integration of DSPs in vehicles not only enhances safety but also contributes to the overall driving experience, indicating a promising growth outlook in the coming years.

Advancements in Telecommunications

The Global Digital Signal Processor (DSP) Market Industry is significantly influenced by advancements in telecommunications, particularly with the rollout of 5G networks. The demand for high-speed data transmission and real-time processing capabilities necessitates the integration of DSPs in network infrastructure. As telecommunications companies invest in upgrading their systems, the market is poised for substantial growth. The anticipated expansion of the DSP market aligns with the broader telecommunications sector's evolution, suggesting a potential market value of 58.5 USD Billion by 2035, driven by the need for enhanced communication technologies.

Emergence of Artificial Intelligence

The Global Digital Signal Processor (DSP) Market Industry is being transformed by the emergence of artificial intelligence (AI) and machine learning technologies. DSPs are essential for processing large volumes of data in real-time, making them integral to AI applications across various sectors, including healthcare, finance, and manufacturing. As organizations increasingly leverage AI for data analysis and decision-making, the demand for DSPs is expected to rise. This trend underscores the potential for innovation within the DSP market, as companies seek to enhance their capabilities through advanced signal processing solutions.

Rising Demand for Consumer Electronics

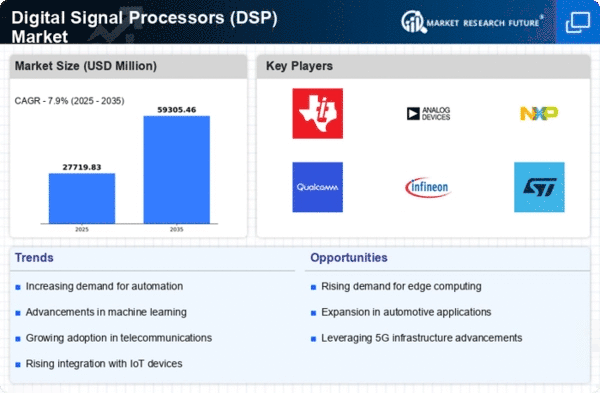

The Global Digital Signal Processor (DSP) Market Industry experiences heightened demand due to the proliferation of consumer electronics such as smartphones, tablets, and smart home devices. As these devices increasingly incorporate advanced audio and video processing capabilities, the need for efficient DSP solutions becomes paramount. In 2024, the market is projected to reach 25.7 USD Billion, reflecting the growing consumer appetite for high-quality multimedia experiences. This trend indicates a robust growth trajectory, as manufacturers seek to enhance product performance through sophisticated signal processing technologies.

Increased Investment in Research and Development

The Global Digital Signal Processor (DSP) Market Industry benefits from increased investment in research and development across various sectors. Companies are focusing on developing next-generation DSP technologies that offer improved performance and energy efficiency. This emphasis on innovation is likely to drive market growth, as organizations seek to stay competitive in a rapidly evolving technological landscape. The projected compound annual growth rate of 7.78% from 2025 to 2035 indicates a strong commitment to advancing DSP capabilities, which could lead to the introduction of groundbreaking products and applications.