Rising Demand for Automation

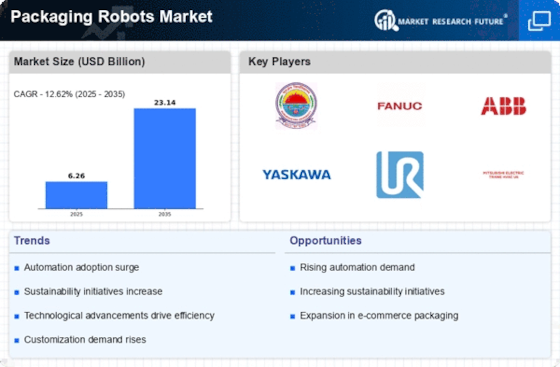

The Packaging Robots Market is experiencing a notable surge in demand for automation across various sectors. Industries such as food and beverage, pharmaceuticals, and consumer goods are increasingly adopting packaging robots to enhance efficiency and reduce labor costs. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend is driven by the need for faster production rates and improved accuracy in packaging processes. As companies strive to meet consumer expectations for quick delivery and high-quality products, the integration of packaging robots becomes essential. The Packaging Robots Market is thus positioned to benefit significantly from this growing inclination towards automation, as businesses seek to streamline operations and maintain competitiveness.

Evolving Consumer Preferences

The Packaging Robots Market is adapting to evolving consumer preferences that demand faster and more customized packaging solutions. As consumers increasingly seek personalized products and rapid delivery, companies are compelled to innovate their packaging processes. The integration of packaging robots allows for greater flexibility and speed in production lines, enabling manufacturers to respond swiftly to market trends. Recent studies suggest that businesses utilizing advanced packaging technologies can reduce time-to-market by up to 25%. This shift towards customization and speed is reshaping the landscape of the Packaging Robots Market, as companies invest in robotic solutions to meet the dynamic needs of consumers and enhance their competitive edge.

Technological Advancements in Robotics

The Packaging Robots Market is witnessing a wave of technological advancements that are enhancing the capabilities and efficiency of packaging robots. Innovations such as artificial intelligence, machine learning, and advanced sensors are enabling robots to perform complex tasks with greater precision and adaptability. These technologies facilitate real-time monitoring and data analysis, allowing for optimized packaging processes. The market for robotics is expected to grow significantly, with projections indicating a potential increase of over 15% in the next few years. As these advancements continue to evolve, the Packaging Robots Market is likely to see a surge in demand for more sophisticated robotic solutions that can cater to diverse packaging needs and improve overall operational efficiency.

Sustainability Initiatives in Packaging

The Packaging Robots Market is increasingly influenced by sustainability initiatives that prioritize eco-friendly packaging solutions. As consumers and regulatory bodies place greater emphasis on environmental responsibility, companies are seeking ways to reduce waste and enhance the sustainability of their packaging processes. The integration of packaging robots can contribute to these efforts by optimizing material usage and minimizing excess waste during production. Data suggests that businesses adopting sustainable practices can improve their market positioning and appeal to environmentally conscious consumers. This trend is likely to drive growth in the Packaging Robots Market, as organizations invest in robotic technologies that align with their sustainability goals and enhance their overall brand image.

Labor Shortages and Workforce Challenges

The Packaging Robots Market is significantly influenced by ongoing labor shortages and challenges in workforce management. Many industries are facing difficulties in hiring and retaining skilled labor, which has led to increased operational costs and production delays. In response, companies are turning to packaging robots as a viable solution to mitigate these issues. The adoption of robotic systems not only addresses labor shortages but also enhances productivity and consistency in packaging operations. Data indicates that businesses implementing packaging robots can achieve up to a 30% increase in output efficiency. This trend highlights the critical role of automation in overcoming workforce challenges, thereby driving growth in the Packaging Robots Market as organizations seek reliable and efficient solutions.