Growth in Beverage Industry

The beverage industry is experiencing notable growth, which significantly impacts the Oxygen Barrier Material Market. With the rise in consumer preferences for ready-to-drink beverages, manufacturers are increasingly utilizing oxygen barrier materials to prevent oxidation and spoilage. The beverage packaging segment is anticipated to expand at a rate of around 5% annually, driven by innovations in packaging technologies. This trend suggests that the Oxygen Barrier Material Market will benefit from the heightened focus on maintaining the quality and taste of beverages. As companies strive to differentiate their products in a competitive market, the demand for advanced oxygen barrier solutions is likely to increase, further propelling the market forward.

Rising Demand for Packaged Food

The increasing demand for packaged food products is a primary driver of the Oxygen Barrier Material Market. As consumers seek convenience and longer shelf life for food items, manufacturers are turning to advanced oxygen barrier materials to enhance product preservation. According to recent data, the packaged food sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth is likely to spur investments in oxygen barrier technologies, as they play a crucial role in maintaining food quality and safety. Consequently, the Oxygen Barrier Material Market is expected to witness a surge in demand, driven by the need for effective packaging solutions that extend the freshness of food products.

Regulatory Support for Food Safety

Regulatory support for food safety is a crucial driver of the Oxygen Barrier Material Market. Governments worldwide are implementing stringent regulations to ensure food safety and quality, which in turn influences packaging standards. Compliance with these regulations often necessitates the use of advanced oxygen barrier materials that can effectively protect food products from spoilage. As food safety regulations become more rigorous, manufacturers are likely to invest in high-performance oxygen barrier solutions to meet compliance requirements. This trend suggests that the Oxygen Barrier Material Market will continue to expand, as companies prioritize safety and quality in their packaging strategies.

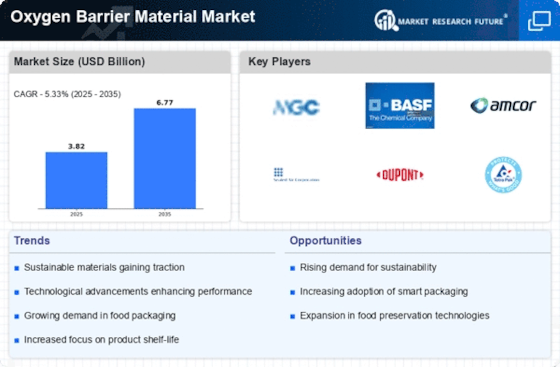

Technological Innovations in Packaging

Technological innovations in packaging are transforming the Oxygen Barrier Material Market. Advances in material science have led to the development of new oxygen barrier films and coatings that offer superior performance. These innovations not only enhance the barrier properties but also improve the sustainability of packaging solutions. For instance, the introduction of biodegradable oxygen barrier materials is gaining traction among environmentally conscious consumers. The market for such materials is projected to grow significantly, as companies seek to align with sustainability goals. This shift indicates that the Oxygen Barrier Material Market is poised for growth, driven by the demand for innovative and eco-friendly packaging solutions.

Increasing Awareness of Shelf Life Extension

Increasing awareness of shelf life extension among consumers is significantly influencing the Oxygen Barrier Material Market. As consumers become more informed about the impact of packaging on food preservation, there is a growing demand for materials that can effectively extend the shelf life of products. This awareness is prompting manufacturers to adopt advanced oxygen barrier technologies that can mitigate spoilage and maintain product integrity. Market analysis indicates that the demand for oxygen barrier materials is expected to rise as consumers prioritize quality and longevity in their food choices. Consequently, the Oxygen Barrier Material Market is likely to experience robust growth, driven by this heightened consumer awareness.