Expansion of Automotive Sector

The automotive sector is undergoing a transformation, with a growing emphasis on performance and efficiency. This shift is positively influencing the thermal barrier coatings market, as manufacturers seek to enhance engine performance and reduce emissions. The Thermal Barrier Coatings Market is likely to see increased adoption of these coatings in automotive applications, particularly in high-performance vehicles and electric vehicles. As automakers strive to meet consumer demands for better fuel economy and lower environmental impact, the integration of thermal barrier coatings is becoming more prevalent. This trend indicates a promising outlook for the market, as the automotive industry continues to evolve and innovate.

Rising Energy Efficiency Regulations

Stringent energy efficiency regulations across various industries are driving the adoption of thermal barrier coatings. The Thermal Barrier Coatings Market is influenced by the need for compliance with environmental standards, which necessitates the use of coatings that enhance thermal efficiency. Industries such as power generation and automotive are increasingly integrating these coatings to improve the performance of their systems. The implementation of regulations aimed at reducing greenhouse gas emissions is likely to propel the demand for thermal barrier coatings, as they contribute to energy savings and improved operational efficiency. This trend suggests a growing market potential as companies strive to meet regulatory requirements while enhancing their product offerings.

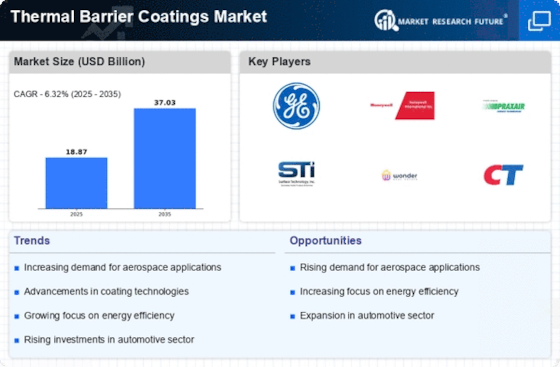

Increasing Demand in Aerospace Sector

The aerospace sector is witnessing a notable surge in demand for thermal barrier coatings, primarily due to the need for enhanced performance and durability in aircraft engines. Thermal Barrier Coatings Market is experiencing growth as manufacturers seek to improve fuel efficiency and reduce emissions. The increasing focus on lightweight materials and advanced manufacturing techniques further propels this demand. According to industry estimates, the aerospace segment is projected to account for a significant share of the thermal barrier coatings market, driven by innovations in engine design and the need for high-temperature resistance. As airlines and manufacturers prioritize operational efficiency, the adoption of advanced thermal barrier coatings is likely to expand, indicating a robust growth trajectory for the industry.

Growing Investment in Renewable Energy

Investment in renewable energy sources is on the rise, leading to increased demand for thermal barrier coatings in energy generation applications. The Thermal Barrier Coatings Market is poised to benefit from this trend, as these coatings are essential for enhancing the efficiency and durability of components used in renewable energy systems. Wind turbines and solar power installations require materials that can withstand extreme conditions, making thermal barrier coatings a critical component. As governments and organizations prioritize sustainable energy solutions, the market for thermal barrier coatings is likely to expand, reflecting a broader commitment to renewable energy initiatives.

Technological Innovations in Coating Applications

Technological advancements in coating applications are significantly impacting the thermal barrier coatings market. Innovations such as plasma spraying and electron beam physical vapor deposition are enhancing the performance characteristics of thermal barrier coatings. The Thermal Barrier Coatings Market is benefiting from these advancements, which allow for better adhesion, durability, and thermal resistance. As industries seek to optimize their processes and improve product longevity, the demand for advanced coating technologies is likely to increase. Furthermore, the development of new materials and formulations is expected to open new avenues for application, potentially expanding the market reach and driving growth in various sectors.