Expansion of Agricultural Sector

The agricultural sector's expansion is emerging as a vital driver for the OTR Tire Market. With the increasing mechanization of farming practices, there is a growing need for specialized tires that can support agricultural machinery. In 2025, the agricultural machinery market is projected to grow by approximately 4%, which will likely lead to a corresponding increase in demand for OTR tires designed for agricultural applications. This trend indicates a shift towards more efficient farming practices, necessitating the development of tires that can perform well in diverse terrains. The OTR Tire Market must respond to this demand by offering tailored solutions that enhance productivity in agriculture.

Sustainability and Eco-Friendly Practices

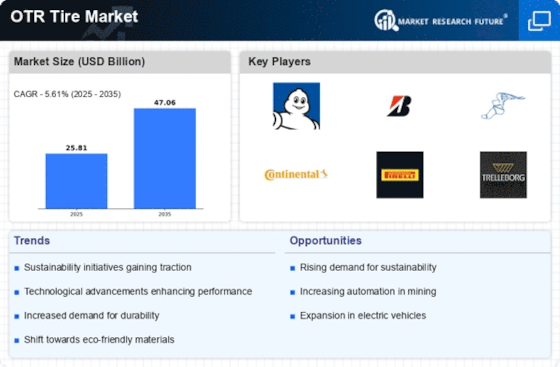

Sustainability initiatives are increasingly becoming a focal point within the OTR Tire Market. As environmental concerns rise, manufacturers are exploring eco-friendly materials and production processes. The demand for sustainable tires, which utilize recycled materials and reduce carbon footprints, is expected to grow. In 2025, the market for eco-friendly OTR tires could represent around 10% of the overall industry. This shift not only aligns with global sustainability goals but also appeals to consumers who prioritize environmentally responsible products. Consequently, the OTR Tire Market must adapt to these changing preferences to remain competitive.

Regulatory Compliance and Safety Standards

The OTR Tire Market is significantly influenced by stringent regulatory compliance and safety standards imposed by various authorities. These regulations are designed to ensure that tires meet specific performance criteria, particularly in hazardous environments such as construction sites and mining operations. As safety becomes a priority, manufacturers are compelled to innovate and produce tires that not only comply with these regulations but also enhance operational safety. In 2025, it is anticipated that compliance-related expenditures will account for a substantial portion of the OTR Tire Market, as companies strive to avoid penalties and ensure the safety of their workforce.

Technological Innovations in Tire Manufacturing

Technological advancements are reshaping the OTR Tire Market, as manufacturers increasingly invest in innovative materials and production techniques. The introduction of smart tires, which incorporate sensors to monitor tire pressure and temperature, is gaining traction. These innovations not only enhance performance but also extend the lifespan of tires, thereby reducing overall costs for operators. In 2025, it is estimated that the market for smart tires could account for approximately 15% of the OTR Tire Market. This shift towards technology-driven solutions indicates a potential for improved safety and operational efficiency, making it a critical driver for market growth.

Increasing Demand for Construction and Mining Activities

The OTR Tire Market is experiencing a notable surge in demand, primarily driven by the expansion of construction and mining activities. As infrastructure projects proliferate, the need for heavy machinery equipped with durable tires becomes paramount. In 2025, the construction sector is projected to grow at a rate of 5.5%, which directly correlates with the rising consumption of OTR tires. Additionally, the mining industry, which has seen a resurgence in commodity prices, is likely to further bolster this demand. The OTR Tire Market must adapt to these trends by providing tires that can withstand the rigors of these demanding environments, ensuring safety and efficiency in operations.