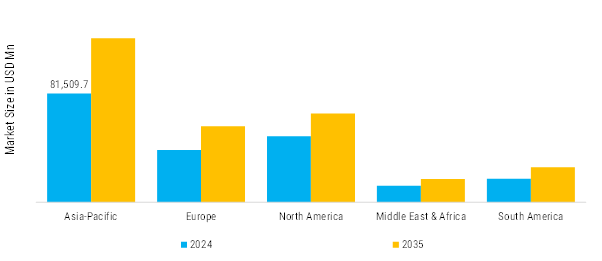

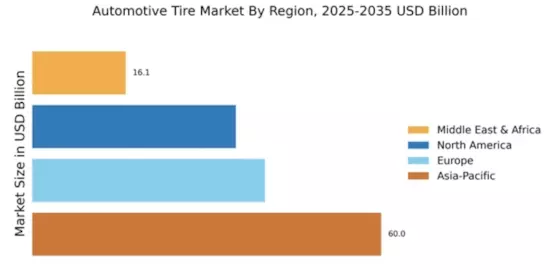

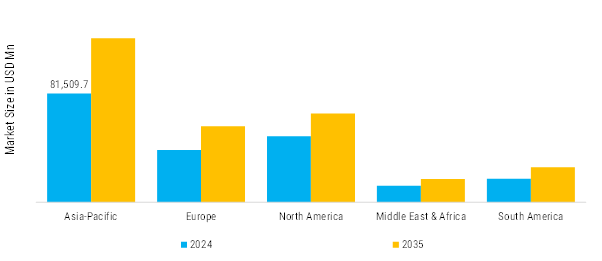

Based on region, the Global House Wraps Market is segmented into North America, Europe, Asia-Pacific, South America and Middle East and Africa. Asia-Pacific accounted for the largest market share in 2024 and is anticipated to reach USD 122,959.3 Million by 2035. Asia-Pacific is projected to grow at the highest CAGR of 5.3% during the forecast period.

Europe: Experiencing Dynamic Growth

The European market is being driven by the rising demand from consumers for ultra-high-performance tires that are dependable and long-lasting. Additionally, the market is expanding due to the rising demand for tires with improved all-terrain capabilities, noise reduction, and fuel efficiency. The market is also being driven by the growing popularity of autonomous and electric automobiles. Furthermore, the demand is being positively impacted by continuous developments in Tire manufacturing technology, such as the creation of new materials, Tire designs, and production procedures. Furthermore, tighter rules have been implemented in the automotive industry as a result of growing concerns about environmental sustainability and lowering carbon emissions, which has improved the market picture. Aside from this, the market is being supported by ongoing infrastructure improvements, such as the creation of new transit systems or the extension of road networks. Germany's automobile Tire market benefits from strong vehicle production and sales as a hub for major automakers like Mercedes-Benz, BMW, and Volkswagen.

North America: Emerging Operation Market

North America region includes the US Canada and Mexico. The automotive market in North America is regarded as mature. By boosting capital investment or moving to regions with easy access to raw resources, North American manufacturers are attempting to lower labour costs. The expansion of the North American tire market is fuelled by initiatives by major automakers that concentrate on creating cutting-edge tires for passenger cars. Furthermore, a greater emphasis on lowering carbon footprints and the growing demand for fuel-efficient automobiles drive the Additionally, by diversifying their product lines and making investments in tire technologies, leading industry participants GoodYear, Cooper Tire, Michelin, Continental, and Michelin have helped the region flourish.

South America: Emerging and Growing

Rising car ownership, a growing preference for riding, and a rapid transition to electric vehicles are the main causes of the increase in Tire consumption in Central & South American nations. Consequently, these nations witnessed an increase in job openings and incomes. As a result, consumer spending increased throughout the Central & South American nations. Vehicle purchases increased as a result of rising consumer spending and per capita expenditure. As a result, the increase in passenger car sales is driving the market and favourably affecting Tire demand.

Asia-pacific: Expanding Operations

Diverse consumer tastes, disparate regulatory frameworks, and differing degrees of market maturity among nations define the region's market. The market is growing as a result of growing urbanisation, increased vehicle ownership rates, and the existence of significant automotive production centres. All Tire segments, from economy to premium, show robust demand in the area, which is indicative of the various economic environments and consumer preferences seen in various nations. Because of the massive investment in the Tire sector, China is expected to dominate the region. In terms of volume, the Tire industry in China is the biggest in the world. The 38 largest member businesses of the China Rubber Industry Association produced more than 500 million tires in 2021, up 11.28% from 2020, according to the China Rubber Industry Association Tire Branch report. The demand for cars has also increased to an all-time high due to the development of the middle class, which has led to a booming market for tires of all kinds. During the projection period, technological innovation and significant R&D expenditures by major firms may contribute to the Asia Pacific region's continued dominance. With massive sales of cutting-edge tires including airless, 3D-printed, and puncture-proof tires, China is predicted to hold the greatest market share in the Asia-Pacific region.

Middle-East & Africa: Driven by Increasing Urbanization

It is anticipated that economic, climatic, and infrastructure considerations would quickly change the Middle Eastern Tire industry. Because high temperatures cause significant Tire wear, there is an increasing need for Tires that are both robust and heat-resistant. The region's harsh climate, which ranges from searing desert heat to coastal humidity, makes specialised tires more necessary to handle these difficult conditions. Because SUVs, luxury automobiles, and 4x4s are in great demand in the area, off-road and all-terrain tires are popular. The commercial vehicle industry is boosted by the Middle East's constantly growing urban regions and infrastructural initiatives. The need for heavy-duty and commercial tires is greatly increased by the transportation, construction, and logistics sectors. Customers' preferences for comfort and quality are reflected in the region's status as a major corporate hub and popular tourist destination, which fuels demand for dependable and secure tires. In order to increase their market share and meet the growing demand for tires, Middle Eastern tire producers are also actively working to improve the comfort and quality of their products.