Surge in Sports-Related Injuries

The Orthopedic Navigation System Market is also experiencing growth due to a surge in sports-related injuries, particularly among younger populations. As participation in sports and physical activities increases, so does the incidence of injuries requiring surgical intervention. Orthopedic navigation systems play a crucial role in the treatment of these injuries, providing surgeons with the tools needed for precise and effective procedures. Market data indicates that the segment related to sports medicine is expected to grow significantly, with projections suggesting an increase of approximately 11% in the orthopedic navigation system market over the next few years. This trend highlights the importance of navigation systems in addressing the needs of active individuals.

Increasing Incidence of Orthopedic Disorders

The Orthopedic Navigation System Market is significantly influenced by the rising incidence of orthopedic disorders, particularly among the aging population. Conditions such as osteoarthritis and fractures are becoming more prevalent, necessitating effective surgical interventions. Recent statistics suggest that the global burden of orthopedic disorders is expected to increase, leading to a higher demand for orthopedic surgeries. Consequently, the need for advanced navigation systems that improve surgical outcomes is likely to grow. This trend may drive market expansion, with projections indicating a potential increase in market size by approximately 15% over the next few years as healthcare providers seek to enhance their surgical capabilities.

Rising Demand for Minimally Invasive Surgeries

The Orthopedic Navigation System Market is witnessing a growing preference for minimally invasive surgical techniques. These procedures offer numerous benefits, including reduced postoperative pain, shorter hospital stays, and quicker recovery times. As patients increasingly seek less invasive options, orthopedic surgeons are adopting navigation systems that facilitate these techniques. Market data indicates that the minimally invasive surgery segment is projected to account for a substantial share of the orthopedic navigation system market, with an expected growth rate of around 12% over the next five years. This trend underscores the importance of navigation systems in enhancing surgical efficiency and patient satisfaction.

Growing Investment in Healthcare Infrastructure

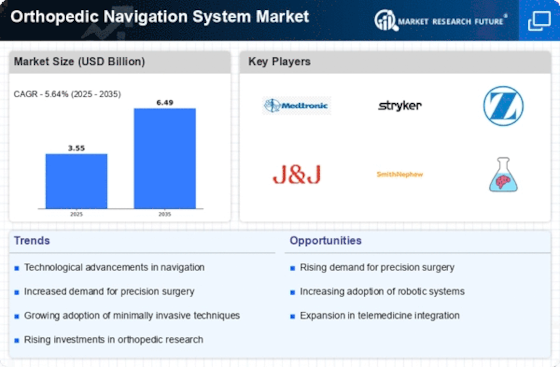

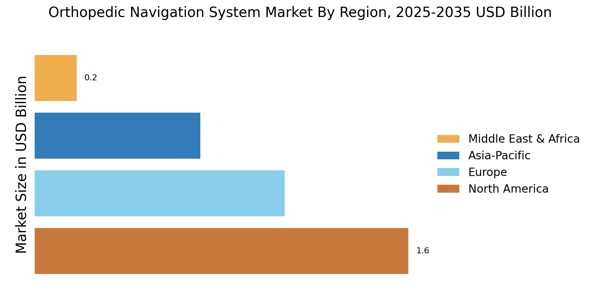

The Orthopedic Navigation System Market is benefiting from increased investment in healthcare infrastructure across various regions. Governments and private entities are allocating substantial resources to modernize surgical facilities and improve patient care. This investment often includes the acquisition of advanced orthopedic navigation systems, which are essential for enhancing surgical precision and efficiency. As healthcare facilities upgrade their technology, the demand for orthopedic navigation systems is expected to rise. Market analysis suggests that this trend could lead to a compound annual growth rate of around 9% in the orthopedic navigation system market, reflecting the ongoing commitment to improving surgical outcomes and patient safety.

Technological Advancements in Orthopedic Navigation Systems

The Orthopedic Navigation System Market is experiencing a surge in technological advancements that enhance surgical precision and outcomes. Innovations such as augmented reality and advanced imaging techniques are becoming increasingly prevalent. These technologies facilitate real-time visualization of anatomical structures, thereby improving the accuracy of orthopedic procedures. According to recent data, the integration of these advanced systems has been linked to a reduction in surgical complications and improved recovery times. As hospitals and surgical centers invest in these cutting-edge technologies, the demand for orthopedic navigation systems is expected to rise significantly, potentially leading to a market growth rate of over 10% annually in the coming years.