Flavor Innovation

Flavor innovation plays a crucial role in driving the Organic Chips Market. As competition intensifies, brands are increasingly focusing on unique and diverse flavor profiles to attract consumers. This trend is evident in the introduction of exotic flavors and combinations that cater to evolving palates. Market data indicates that innovative flavors can lead to a 20% increase in sales for snack products. The Organic Chips Market is witnessing a wave of creativity, with manufacturers experimenting with ingredients such as herbs, spices, and even superfoods to create distinctive offerings. This not only enhances the consumer experience but also encourages trial and repeat purchases, thereby fostering brand loyalty. The ability to adapt to changing consumer preferences through flavor innovation is likely to be a key differentiator in this competitive landscape.

Growing Snackification Trend

The growing trend of snackification is a notable driver for the Organic Chips Market. As lifestyles become busier, consumers are increasingly opting for convenient snack options that fit into their on-the-go routines. This shift towards snacking rather than traditional meals has led to a surge in demand for portable and healthy snack alternatives. Market Research Future indicates that snack foods account for nearly 50% of total food consumption in certain demographics. The Organic Chips Market is well-positioned to capitalize on this trend, as organic chips offer a guilt-free snacking option that aligns with health-conscious consumer preferences. The appeal of organic chips as a convenient yet nutritious snack is likely to drive further growth in this segment, as consumers seek out products that satisfy their cravings without compromising their health.

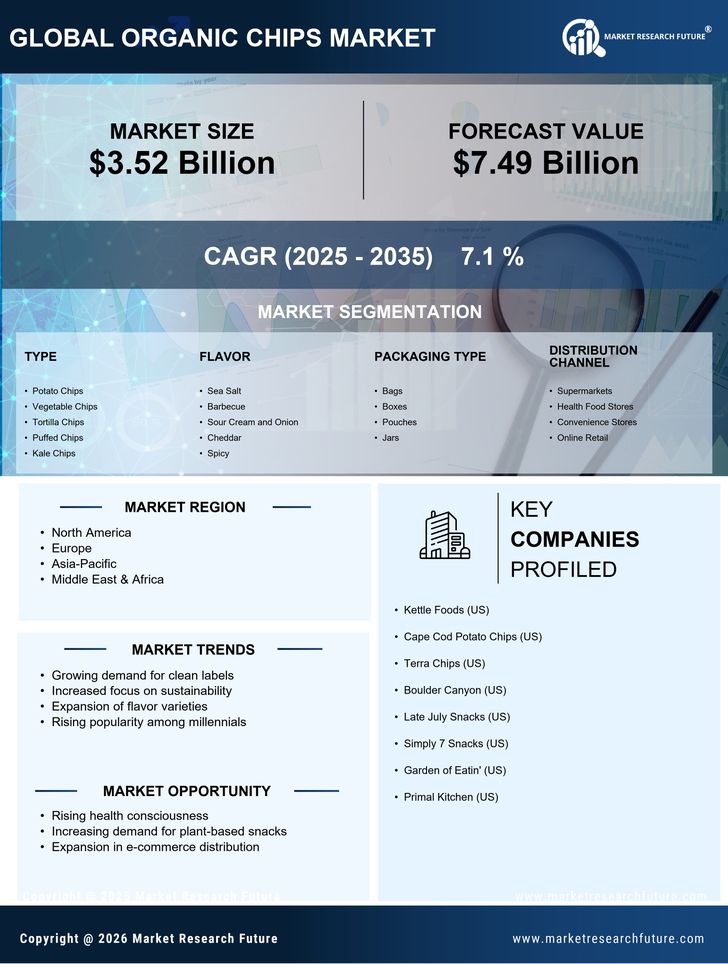

Health-Conscious Consumption

The increasing trend towards health-conscious consumption is a pivotal driver for the Organic Chips Market. Consumers are becoming more aware of the nutritional content of their food, leading to a surge in demand for healthier snack options. According to recent data, the organic snack market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This shift towards organic products is not merely a fad; it reflects a broader societal movement towards wellness and preventive health measures. As consumers seek alternatives to traditional snacks laden with artificial ingredients, the Organic Chips Market stands to benefit significantly. The emphasis on clean labels and transparency in sourcing further enhances the appeal of organic chips, positioning them as a preferred choice among discerning consumers.

Sustainable Sourcing Practices

Sustainable sourcing practices are increasingly influencing the Organic Chips Market. As consumers become more environmentally conscious, they are seeking products that align with their values. This has prompted manufacturers to adopt sustainable practices in sourcing raw materials, which not only enhances brand reputation but also meets consumer demand for ethical products. Data suggests that brands emphasizing sustainability can experience a 15% increase in customer loyalty. The Organic Chips Market is thus witnessing a shift towards sourcing ingredients from certified organic farms and implementing eco-friendly production methods. This commitment to sustainability resonates with consumers who prioritize environmental stewardship, making it a vital driver for growth in the organic chips segment. The integration of sustainability into the supply chain is likely to become a standard expectation rather than a competitive advantage.

Increased Availability in Retail Channels

The increased availability of organic chips in various retail channels is a significant driver for the Organic Chips Market. Retailers are expanding their organic product offerings in response to consumer demand, making organic chips more accessible than ever. Data indicates that organic snacks are now available in over 70% of grocery stores, a notable increase from previous years. This enhanced distribution network not only facilitates consumer access but also raises awareness about organic options. The Organic Chips Market benefits from this trend as more consumers encounter these products during their shopping experiences. Additionally, the rise of e-commerce platforms has further broadened the reach of organic chips, allowing consumers to purchase their favorite snacks online. This increased availability is likely to contribute to sustained growth in the organic chips segment.