Research Methodology on IoT Chips Market

Introduction

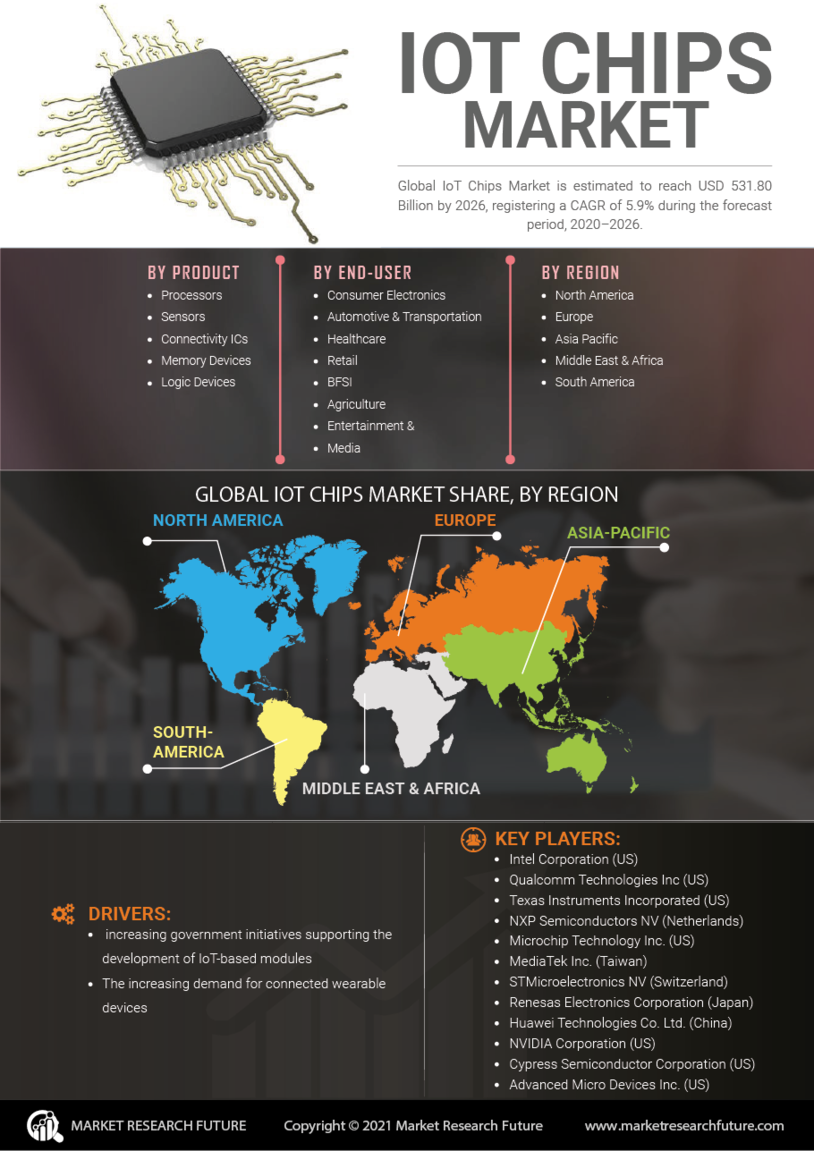

The Internet of Things (IoT) is becoming an increasingly important part of our ever more connected world. There are numerous applications for this technology, ranging from energy management to medical device management. IoT chips, which are embedded in many devices, provide the intelligence and communication capabilities for many of these technologies. Market Research Future has published a report that provides an in-depth analysis of the global IoT chips market. In order to analyze the data from this report, a comprehensive research methodology is developed.

Research Approach and Design

The research approach and design that was used to analyze the market research report by MarketResearchFuture.com relied heavily on both primary and secondary sources of data and information. Primary data was gathered via a series of interviews and surveys that were conducted with industry experts and stakeholders who were knowledgeable about the market and had a deep understanding of it. The interviews and surveys were conducted online through email and phone.

Secondary data sources included both online and offline sources. Online sources included trade websites and databases such as Hoovers, Bloomberg, and Factiva. Offline resources included industry reports, published literature, and trade magazines. The data was evaluated and used to build an understanding of the global IoT chips market.

Methodology

The research for the report is conducted using the market research methodology. This method is designed to provide an in-depth analysis of the market by gathering data from various sources and then analyzing the data using a variety of techniques.

In order to gain an understanding of the global market for IoT chips, the following steps were taken:

Step 1: Identify the Market: The first step was to identify the market and determine its size. This was done by collecting data from various sources to build an understanding of the currently available data.

Step 2: Identify Key Players: The second step was to identify the key players in the market and analyze the competitive landscape. This was done by collecting data from industry sources and evaluating the market based on their market share.

Step 3: Analyze Market Segments: The third step was to analyze various market segments and the trends of each segment in order to gain an understanding of the market dynamics. This was done by collecting data from various sources and evaluating the data based on its implications for the market.

Step 4: Evaluate Opportunity and Growth Potential: The fourth step was to evaluate the growth potential of the market and the opportunities available. This was done by collecting data on the historical growth of the market and analyzing the potential for future growth.

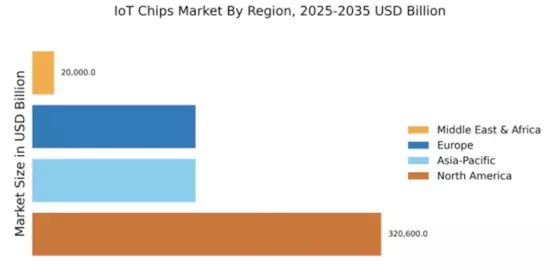

Step 5: Market Forecasting: The fifth step was to develop a forecast of the global market for IoT chips. This was done by analyzing the historical data, assessing the potential of the market, and identifying trends that could impact the forecast.

Finally, a detailed report was generated after analyzing the data and evaluating the growth potential of the global market for IoT chips.

Conclusion

This research methodology was used by Market Research Future to analyze the global IoT chips market in order to provide an in-depth analysis of the market and its growth potential along with a forecast from 2023 to 2030. Primary and secondary sources of data were used to build an understanding of the market and various techniques were employed to develop a forecast of the market. This research methodology was designed to provide an in-depth analysis and ensure an accurate forecast of the global market for IoT chips.