Regulatory Support for Green Chemistry

Regulatory frameworks are increasingly favoring the use of organic chemicals, which is a significant driver for the Organic Chemicals Market. Governments worldwide are implementing stringent regulations aimed at reducing the environmental impact of chemical production. These regulations often promote the adoption of green chemistry principles, which encourage the use of renewable resources and minimize hazardous substances. As a result, companies that invest in organic chemical production are likely to benefit from incentives and support, fostering growth in this sector. The regulatory landscape is expected to evolve, further bolstering the Organic Chemicals Market as businesses adapt to comply with these new standards.

Rising Demand for Eco-Friendly Products

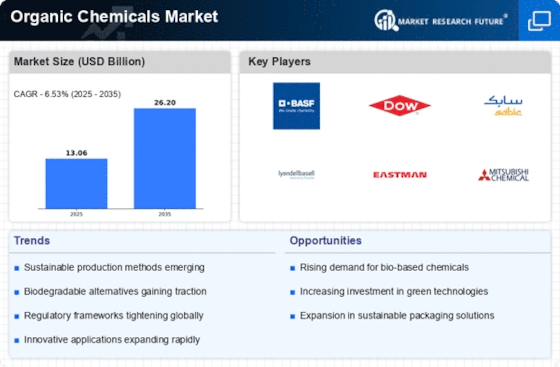

The Organic Chemicals Market is experiencing a notable increase in demand for eco-friendly products. Consumers are becoming increasingly aware of environmental issues, leading to a shift towards sustainable alternatives. This trend is reflected in the growing preference for organic chemicals in various applications, including agriculture, personal care, and cleaning products. According to recent data, the organic chemicals segment is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This shift not only aligns with consumer preferences but also encourages manufacturers to innovate and develop greener products, thereby enhancing their market position within the Organic Chemicals Market.

Expanding Applications Across Industries

The versatility of organic chemicals is driving their adoption across various industries, which is a key factor in the growth of the Organic Chemicals Market. From pharmaceuticals to agriculture, organic chemicals are finding applications that enhance product performance and sustainability. For example, the use of organic solvents in the pharmaceutical industry is increasing due to their lower toxicity and environmental impact. Additionally, the agricultural sector is increasingly utilizing organic pesticides and fertilizers, which are perceived as safer alternatives. This broadening scope of applications is expected to contribute to a robust growth trajectory for the Organic Chemicals Market, as diverse sectors seek to incorporate organic solutions.

Increased Investment in Research and Development

Investment in research and development is a significant driver for the Organic Chemicals Market. Companies are recognizing the importance of innovation in maintaining competitive advantage and meeting evolving consumer demands. Increased funding for R&D initiatives is leading to the discovery of new organic compounds and improved production methods. This focus on innovation is crucial, as it allows companies to develop products that align with sustainability goals and regulatory requirements. As a result, the Organic Chemicals Market is likely to witness a surge in new product offerings and enhanced production capabilities, further solidifying its position in the broader chemical market.

Technological Innovations in Production Processes

Technological advancements are playing a crucial role in shaping the Organic Chemicals Market. Innovations in production processes, such as biocatalysis and advanced separation techniques, are enhancing efficiency and reducing costs. These technologies enable manufacturers to produce organic chemicals with lower energy consumption and waste generation. For instance, the implementation of continuous flow chemistry has been shown to improve reaction efficiency and product yield. As these technologies become more accessible, they are likely to drive the growth of the Organic Chemicals Market, allowing companies to meet the increasing demand for sustainable products while maintaining profitability.