US Organic Chemicals Market Summary

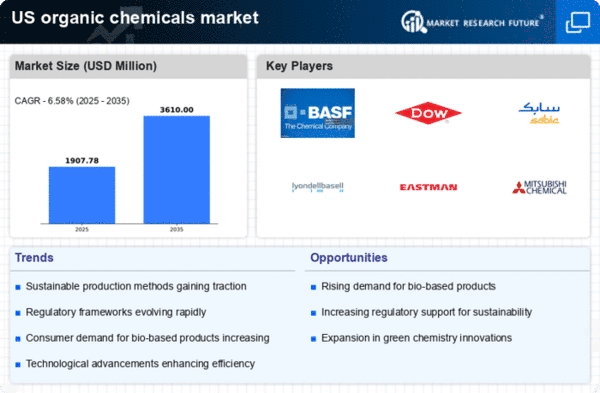

As per Market Research Future analysis, the US organic chemicals market Size was estimated at 1790.0 USD Million in 2024. The US organic chemicals market is projected to grow from 1907.78 USD Million in 2025 to 3610.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 6.5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US organic chemicals market is experiencing a transformative shift towards sustainability and innovation.

- Sustainability initiatives are driving a notable transformation in the US organic chemicals market.

- Technological advancements are enhancing production efficiency and product quality across various segments.

- The specialty chemicals segment remains the largest, while bio-based products are emerging as the fastest-growing segment.

- Regulatory support for green chemistry and rising demand in end-use industries are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 1790.0 (USD Million) |

| 2035 Market Size | 3610.0 (USD Million) |

| CAGR (2025 - 2035) | 6.58% |

Major Players

BASF SE (DE), Dow Inc. (US), SABIC (SA), LyondellBasell Industries N.V. (NL), Eastman Chemical Company (US), Mitsubishi Chemical Corporation (JP), AkzoNobel N.V. (NL), Solvay S.A. (BE), Covestro AG (DE)