Government Investments and Initiatives

Government investments and initiatives play a crucial role in shaping the Optical Satellite Communication Market. Various countries are recognizing the strategic importance of satellite communication for national security, economic development, and technological leadership. As a result, governments are allocating substantial funding towards research and development in optical communication technologies. For example, initiatives aimed at enhancing satellite constellations and improving communication infrastructure are being launched, which could lead to increased collaboration between public and private sectors. This trend is expected to bolster the market, with forecasts indicating that government spending on satellite communication could exceed billions of dollars in the next decade.

Emerging Applications in Various Sectors

The Optical Satellite Communication Market is expanding due to emerging applications across various sectors. Industries such as agriculture, healthcare, and disaster management are increasingly leveraging optical satellite communication for real-time data transmission and monitoring. For instance, in agriculture, optical satellites can provide critical data for precision farming, enabling farmers to optimize resource use and increase yields. Similarly, in healthcare, optical communication systems can facilitate telemedicine services in remote areas, improving access to medical care. The versatility of optical satellite systems is likely to drive their adoption, with market analysts predicting a substantial increase in demand as more sectors recognize the benefits of these advanced communication technologies.

Increased Demand for High-Speed Connectivity

The demand for high-speed connectivity is a primary driver in the Optical Satellite Communication Market. As the world becomes increasingly interconnected, the need for reliable and fast communication solutions has surged. This is particularly evident in remote and underserved regions where traditional communication infrastructure is lacking. Optical satellite systems offer a viable solution, providing high data rates that can support various applications, from broadband internet access to real-time data transmission for IoT devices. Market analyses indicate that the demand for optical communication systems is expected to rise, with projections estimating a market size reaching several billion dollars by 2030, driven by this insatiable need for connectivity.

Focus on Sustainability and Environmental Impact

The Optical Satellite Communication Market is witnessing a growing focus on sustainability and reducing environmental impact. As concerns about climate change and resource depletion intensify, there is a push towards developing eco-friendly communication technologies. Optical satellite systems, which utilize light for data transmission, are inherently more energy-efficient compared to traditional radio frequency systems. This efficiency not only reduces operational costs but also minimizes the carbon footprint associated with satellite operations. Furthermore, regulatory bodies are increasingly advocating for sustainable practices in satellite deployment, which is likely to drive investment in optical communication technologies that align with these environmental goals.

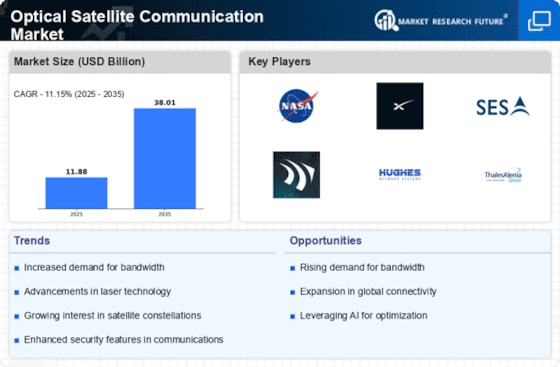

Technological Advancements in Optical Satellite Communication

The Optical Satellite Communication Market is experiencing rapid technological advancements that enhance data transmission capabilities. Innovations such as laser communication systems and advanced modulation techniques are being developed, allowing for higher bandwidth and lower latency. For instance, the integration of photonic integrated circuits is expected to revolutionize satellite communication by enabling more compact and efficient systems. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. These advancements not only improve communication efficiency but also expand the potential applications of optical satellite systems in various sectors, including telecommunications and defense.