Rising Demand in Electronics

The Optical Glass Market experiences a notable surge in demand driven by the increasing integration of optical glass components in electronic devices. As consumer electronics evolve, the need for high-quality lenses and optical components becomes paramount. For instance, the market for optical glass in smartphones and cameras is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 8% over the next few years. This trend indicates that manufacturers are prioritizing optical clarity and durability, which are essential for enhancing user experience. Consequently, the Optical Glass Market is likely to witness substantial investments aimed at improving production techniques and material quality to meet this rising demand.

Growth in Healthcare Applications

The Optical Glass Market is significantly influenced by the expanding applications in the healthcare sector. Optical glass is crucial in medical imaging devices, such as endoscopes and microscopes, which are essential for accurate diagnostics and treatment. The increasing prevalence of chronic diseases and the demand for advanced medical technologies are propelling the market forward. Reports indicate that the medical optics segment is expected to grow at a rate of approximately 7% annually, reflecting the critical role of optical glass in enhancing healthcare outcomes. This growth suggests that the Optical Glass Market must adapt to the evolving needs of healthcare professionals and invest in innovative optical solutions.

Advancements in Photonics Technology

The Optical Glass Market is poised for growth due to advancements in photonics technology, which encompasses the generation, manipulation, and detection of photons. Innovations in this field are leading to the development of new optical materials and coatings that enhance performance and efficiency. For example, the integration of optical glass in fiber optic communication systems is becoming increasingly prevalent, as it allows for faster data transmission and improved signal quality. The photonics market is projected to expand at a compound annual growth rate of around 10%, indicating a robust demand for optical glass components. This trend suggests that the Optical Glass Market must remain agile and responsive to technological advancements to capitalize on emerging opportunities.

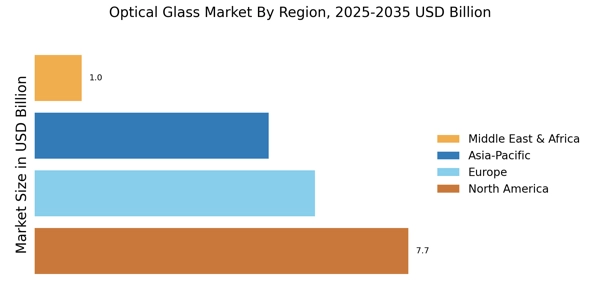

Emerging Markets and Economic Growth

The Optical Glass Market is experiencing growth due to emerging markets and overall economic development. As economies in various regions expand, there is an increasing demand for optical glass in various applications, including telecommunications, automotive, and consumer electronics. Countries with developing economies are investing in infrastructure and technology, which in turn drives the need for high-quality optical components. Market analysis indicates that regions such as Asia-Pacific are expected to witness the highest growth rates, potentially exceeding 9% annually. This trend suggests that the Optical Glass Market must strategically position itself to leverage opportunities in these burgeoning markets.

Increased Investment in Research and Development

The Optical Glass Market is benefiting from increased investment in research and development activities. Companies are focusing on developing innovative optical materials and manufacturing processes to enhance product performance and reduce costs. This trend is particularly evident in the automotive and aerospace sectors, where high-performance optical components are essential for applications such as advanced driver-assistance systems and navigation. The investment in R&D is expected to drive the market forward, with projections indicating a potential growth rate of 6% in the coming years. This focus on innovation suggests that the Optical Glass Market is likely to evolve rapidly, adapting to new challenges and opportunities.