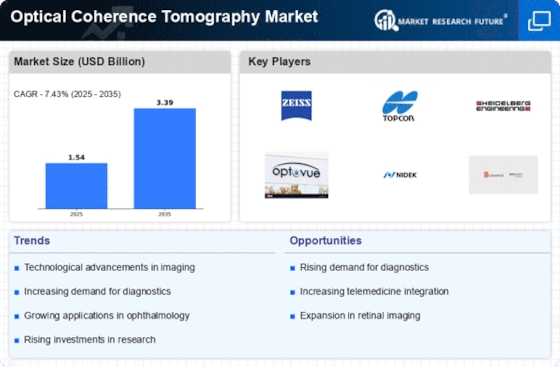

The Optical Coherence Tomography (OCT) market is currently characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for non-invasive imaging solutions in ophthalmology and cardiology. Key players such as Carl Zeiss AG (Germany), Topcon Corporation (Japan), and Heidelberg Engineering GmbH (Germany) are at the forefront, each adopting distinct strategies to enhance their market presence. Carl Zeiss AG (Germany) focuses on innovation, particularly in developing high-resolution imaging systems, while Topcon Corporation (Japan) emphasizes regional expansion and partnerships to bolster its product offerings. Heidelberg Engineering GmbH (Germany) is known for its commitment to integrating artificial intelligence into its OCT systems, thereby enhancing diagnostic capabilities. Collectively, these strategies contribute to a competitive environment that prioritizes technological superiority and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance operational efficiency. The OCT market appears moderately fragmented, with several players vying for market share. However, the influence of major companies is substantial, as they set industry standards and drive innovation. This competitive structure allows for a diverse range of products and services, catering to various customer needs while fostering a culture of continuous improvement.

In August 2025, Carl Zeiss AG (Germany) announced the launch of its latest OCT device, which incorporates advanced AI algorithms for improved image analysis. This strategic move is likely to enhance diagnostic accuracy and streamline workflows in clinical settings, positioning the OCT company as a leader in technological innovation within the OCT market, that too, with reduced optical coherence tomography machine costs. The integration of AI not only reflects a commitment to cutting-edge technology but also addresses the growing demand for efficient diagnostic tools in healthcare.

In September 2025, Topcon Corporation (Japan) entered into a strategic partnership with a leading telemedicine provider to enhance remote diagnostic capabilities using OCT technology. This collaboration is significant as it aligns with the increasing trend towards telehealth solutions, allowing for broader access to advanced imaging technologies. By leveraging telemedicine, Topcon aims to expand its market reach and improve patient outcomes, indicating a proactive approach to evolving healthcare needs.

In July 2025, Heidelberg Engineering GmbH (Germany) unveiled a new software platform designed to integrate seamlessly with its OCT devices, enhancing data management and analysis. This development underscores the importance of software solutions in the OCT market, as it allows healthcare providers to optimize their diagnostic processes. The focus on software integration suggests a shift towards comprehensive solutions that combine hardware and software for improved clinical efficacy.

As of October 2025, the OCT market is witnessing trends such as digitalization, sustainability, and the integration of artificial intelligence, which are reshaping competitive dynamics. Strategic alliances are becoming increasingly prevalent, enabling companies to leverage complementary strengths and enhance their product offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability, as companies strive to meet the growing demands of the healthcare sector.