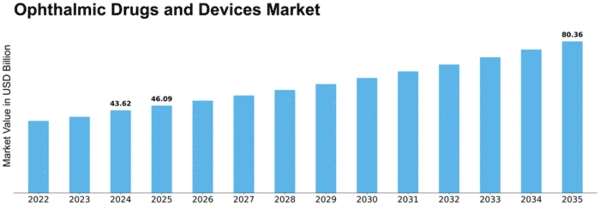

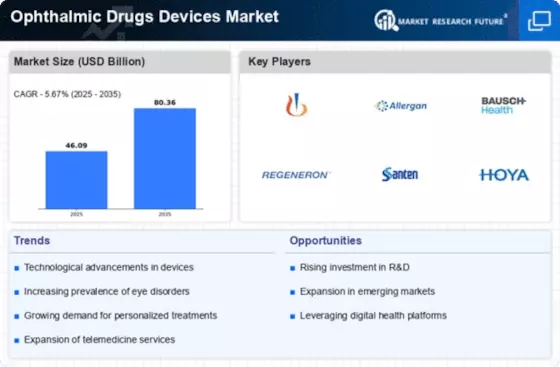

Ophthalmic Drugs Devices Size

Ophthalmic Drugs Devices Market Growth Projections and Opportunities

The Ophthalmic Drugs and Devices Market, a dynamic sector in the healthcare industry, is influenced by various market factors that contribute to its growth and evolution. One key factor is the increasing prevalence of eye disorders and diseases globally. As the aging population expands, the incidence of conditions like glaucoma, macular degeneration, and diabetic retinopathy rises, driving the demand for ophthalmic drugs and devices. Additionally, lifestyle changes and prolonged screen time contribute to the growing cases of myopia and dry eye syndrome, further fueling market growth.

Technological advancements play a pivotal role in shaping the Ophthalmic Drugs and Devices Market. Continuous innovations in drug formulations, surgical techniques, and diagnostic devices enhance the efficacy and precision of treatments. The advent of minimally invasive surgical procedures, such as laser surgeries and micro-incision cataract surgeries, has revolutionized ophthalmic care, offering patients quicker recovery times and reduced postoperative complications. These technological developments attract both healthcare providers and patients, stimulating market expansion.

Furthermore, the regulatory landscape significantly impacts the Ophthalmic Drugs and Devices Market. Stringent regulatory requirements for product approval and quality assurance ensure the safety and effectiveness of ophthalmic drugs and devices. Compliance with these regulations not only safeguards patient health but also builds trust among healthcare professionals and consumers. Market players must navigate these regulatory frameworks, leading to a competitive environment where only products meeting the highest standards gain market acceptance.

The economic landscape and healthcare infrastructure of different regions also contribute to the dynamics of the Ophthalmic Drugs and Devices Market. Developed regions with well-established healthcare systems witness a higher adoption rate of advanced ophthalmic technologies due to better accessibility and affordability. On the other hand, emerging economies are experiencing a growing awareness of eye health, prompting increased investments in healthcare infrastructure. The evolving economic scenarios in these regions present both challenges and opportunities for market players, requiring a tailored approach to meet the diverse needs of each market.

Collaborations and partnerships within the healthcare industry are another crucial market factor. Strategic alliances between pharmaceutical companies, medical device manufacturers, and research institutions foster innovation and accelerate product development. These collaborations enable the pooling of resources, expertise, and technologies, resulting in the introduction of novel drugs and devices to the market. The synergy created through such partnerships enhances the overall competitiveness and sustainability of the Ophthalmic Drugs and Devices Market.

Patient preferences and changing healthcare delivery models also influence the market dynamics. A growing emphasis on patient-centric care and personalized medicine has led to increased demand for customized treatment plans. Ophthalmic drugs and devices that offer better patient outcomes, convenience, and minimal side effects gain traction in the market. Additionally, the shift towards outpatient care and ambulatory surgical centers reflects changing healthcare delivery preferences, impacting the utilization of ophthalmic drugs and devices.

Leave a Comment