Growth in Industrial Automation

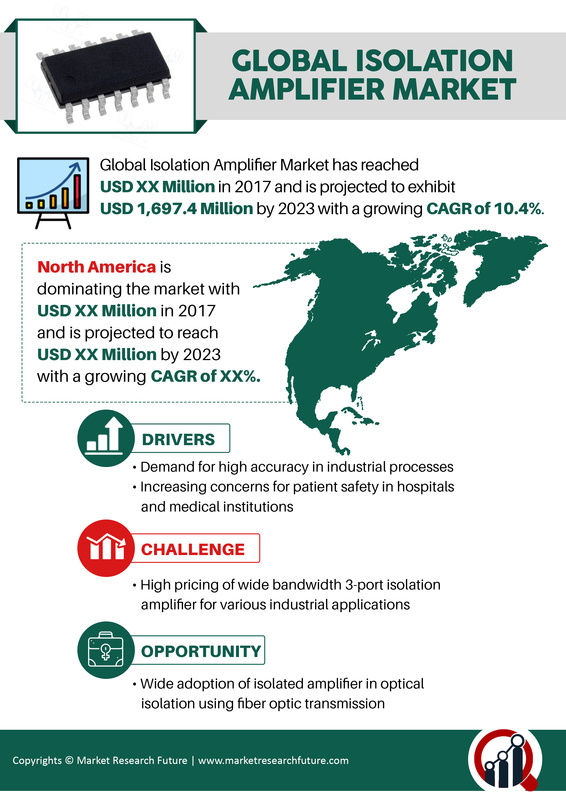

The Global Isolation Amplifier Market Industry is significantly influenced by the ongoing expansion of industrial automation. As industries increasingly adopt automated systems, the need for isolation amplifiers becomes critical to ensure signal integrity and protect equipment from electrical disturbances. These amplifiers play a vital role in various applications, including process control and robotics. The anticipated compound annual growth rate (CAGR) of 10.48% from 2025 to 2035 highlights the potential for growth in this sector, driven by the demand for enhanced efficiency and reliability in industrial operations.

Rising Demand for Medical Devices

The Global Isolation Amplifier Market Industry experiences a surge in demand driven by the increasing adoption of medical devices. Isolation amplifiers are crucial in medical applications, ensuring accurate signal transmission while protecting sensitive equipment from electrical noise. As healthcare technology advances, the need for reliable and precise measurements in devices such as ECGs and EEGs becomes paramount. This trend is reflected in the projected market value of 6.76 USD Billion in 2024, with expectations to reach 20.2 USD Billion by 2035, indicating a robust growth trajectory fueled by innovations in medical technology.

Advancements in Consumer Electronics

The Global Isolation Amplifier Market Industry is also propelled by advancements in consumer electronics. With the proliferation of smart devices and IoT applications, isolation amplifiers are essential for maintaining signal quality and protecting sensitive components from interference. As consumer electronics continue to evolve, manufacturers are increasingly integrating isolation amplifiers into their products to enhance performance and reliability. This trend is expected to contribute to the market's growth, aligning with the overall increase in the market value projected for the coming years.

Emerging Applications in Renewable Energy

The Global Isolation Amplifier Market Industry is witnessing growth due to emerging applications in renewable energy. As the world shifts towards sustainable energy solutions, isolation amplifiers are increasingly utilized in solar inverters and wind turbine systems to ensure efficient energy conversion and signal integrity. This trend aligns with global efforts to enhance energy efficiency and reduce carbon footprints. The anticipated growth in the renewable energy sector is expected to positively impact the isolation amplifier market, contributing to its overall expansion in the coming years.

Regulatory Compliance and Safety Standards

The Global Isolation Amplifier Market Industry is shaped by stringent regulatory compliance and safety standards across various sectors. Industries such as automotive, aerospace, and healthcare are subject to rigorous regulations that mandate the use of isolation amplifiers to ensure safety and reliability. These amplifiers help mitigate risks associated with electrical noise and interference, thereby enhancing the overall safety of electronic systems. As regulations evolve, the demand for isolation amplifiers is likely to increase, further driving market growth and innovation.