North America : Market Leader in Services

North America continues to lead the Offshore Oil Rig Maintenance and Overhaul Services Market, holding a significant market share of 5.0 in 2024. The region's growth is driven by increasing offshore drilling activities, technological advancements, and stringent safety regulations. The demand for efficient maintenance services is further fueled by the need to minimize downtime and enhance operational efficiency in oil extraction processes.

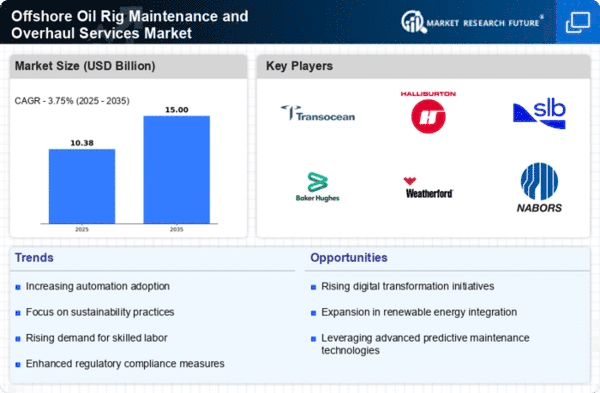

The United States is the primary player in this market, with major companies like Halliburton, Schlumberger, and Transocean leading the charge. The competitive landscape is characterized by a mix of established firms and emerging players, all vying for a share of the lucrative market. The presence of advanced infrastructure and a skilled workforce further solidifies North America's position as a hub for offshore oil rig services.

Europe : Growing Demand for Services

Europe's Offshore Oil Rig Maintenance and Overhaul Services Market is witnessing a resurgence, with a market size of 2.5 in 2024. The growth is attributed to increasing investments in renewable energy and the need for efficient maintenance of aging rigs. Regulatory frameworks promoting safety and environmental sustainability are also key drivers, encouraging companies to invest in advanced maintenance solutions.

Leading countries in this region include the UK and Norway, where major players like Weatherford and Baker Hughes are actively involved. The competitive landscape is evolving, with a focus on innovation and sustainability. The presence of regulatory bodies ensures that companies adhere to strict safety standards, enhancing the overall market environment. "The offshore oil and gas sector is crucial for Europe's energy security and economic growth," states the European Commission.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is emerging as a significant player in the Offshore Oil Rig Maintenance and Overhaul Services Market, with a market size of 1.8 in 2024. The growth is driven by increasing energy demands, particularly in countries like China and India, where offshore exploration activities are on the rise. Regulatory support for energy independence and investments in infrastructure are further propelling market growth.

Countries such as Australia and India are leading the charge, with key players like Nabors Industries and Seadrill expanding their operations. The competitive landscape is marked by a mix of local and international firms, all striving to capture the growing demand for maintenance services. The region's potential is vast, with ongoing investments expected to enhance service capabilities and operational efficiency.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region is gradually developing its Offshore Oil Rig Maintenance and Overhaul Services Market, currently valued at 0.7 in 2024. The growth is primarily driven by the region's rich oil reserves and increasing offshore exploration activities. Regulatory frameworks are evolving to support sustainable practices, which is crucial for attracting foreign investments in maintenance services.

Leading countries in this region include Saudi Arabia and Nigeria, where companies are beginning to invest in modernizing their offshore rigs. The competitive landscape is still in its nascent stages, with a few key players like Petrobras making strides. As the market matures, the focus will shift towards enhancing service quality and operational efficiency to meet international standards.