North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the Offshore Oil and Gas Vessel MRO Services Market, holding a significant market share of 9.75 in 2025. The region's growth is driven by increasing offshore exploration activities, stringent safety regulations, and technological advancements in vessel maintenance. The demand for efficient and reliable MRO services is further fueled by the need to minimize operational downtime and enhance safety standards.

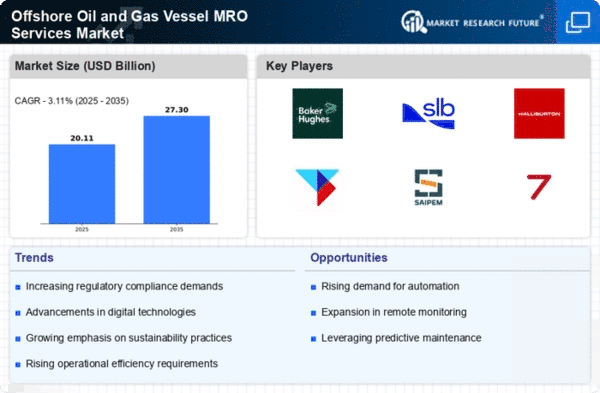

The United States stands out as the leading country in this sector, hosting major players like Baker Hughes, Schlumberger, and Halliburton. The competitive landscape is characterized by a mix of established firms and innovative startups, all vying for market share. The presence of advanced infrastructure and a skilled workforce further solidifies North America's position as a hub for offshore MRO services.

Europe : Emerging Market with Growth Potential

Europe's Offshore Oil and Gas Vessel MRO Services Market is projected to grow, with a market size of 5.85 in 2025. The region benefits from a strong regulatory framework aimed at enhancing safety and environmental standards, which drives demand for MRO services. Additionally, the transition towards sustainable energy sources is prompting investments in upgrading existing vessels, thereby increasing the need for maintenance and repair services.

Leading countries in this region include the UK, Norway, and the Netherlands, where companies like TechnipFMC and Kongsberg Gruppen are prominent. The competitive landscape is evolving, with a focus on innovation and sustainability. The presence of key players and a robust supply chain further enhance Europe's position in The Offshore Oil and Gas Vessel MRO Services.

Asia-Pacific : Rapidly Growing MRO Sector

The Asia-Pacific region is witnessing rapid growth in the Offshore Oil and Gas Vessel MRO Services Market, with a projected size of 3.9 in 2025. This growth is driven by increasing offshore drilling activities, particularly in countries like Australia and Malaysia. The region's demand for MRO services is further supported by government initiatives aimed at enhancing energy security and reducing operational risks in offshore operations.

Countries such as Australia, China, and India are leading the charge in this sector, with a mix of local and international players competing for market share. The competitive landscape is characterized by strategic partnerships and collaborations among key players, including Aker Solutions and Fugro, to leverage technological advancements and improve service delivery.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region represents an emerging market for Offshore Oil and Gas Vessel MRO Services, with a market size of 0.95 in 2025. The growth in this region is primarily driven by increasing investments in offshore oil exploration and production, alongside a growing focus on enhancing operational efficiency. However, challenges such as political instability and regulatory hurdles may impact market growth.

Leading countries in this region include Saudi Arabia and Nigeria, where local and international firms are vying for a share of the MRO market. The competitive landscape is evolving, with key players like Saipem and Subsea 7 establishing a presence to cater to the growing demand for maintenance and repair services in offshore operations.