North America : Leading Market Innovator

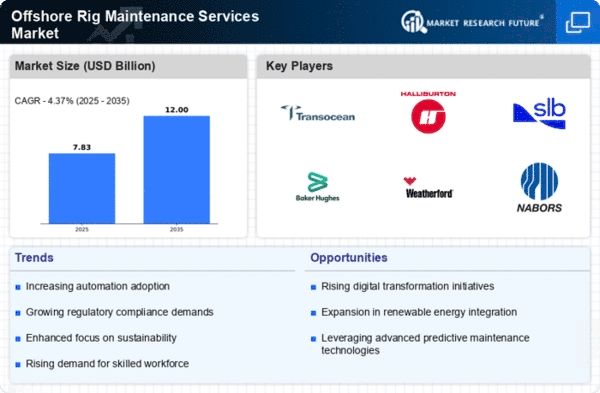

North America continues to lead the Offshore Rig Maintenance Services Market, holding a significant market share of 3.75 in 2024. The region's growth is driven by increasing offshore drilling activities, stringent safety regulations, and technological advancements in maintenance services. The demand for efficient and reliable maintenance solutions is further fueled by the rising focus on sustainability and environmental compliance, making it a key player in the global market. The United States stands out as the primary contributor, with major companies like Halliburton, Schlumberger, and Transocean leading the competitive landscape. The presence of advanced infrastructure and a skilled workforce enhances the region's capability to deliver high-quality services. As the market evolves, these key players are expected to innovate and expand their service offerings, solidifying North America's position as a market leader.

Europe : Emerging Regulatory Frameworks

Europe's Offshore Rig Maintenance Services Market is projected to grow, with a market size of 2.25 in 2024. The region is witnessing increased demand driven by the need for compliance with stringent environmental regulations and a shift towards renewable energy sources. Governments are investing in offshore infrastructure, which is expected to boost maintenance service requirements significantly, creating a favorable environment for market growth. Leading countries such as the UK, Norway, and the Netherlands are at the forefront, with key players like Weatherford and Seadrill establishing a strong presence. The competitive landscape is characterized by collaborations and partnerships aimed at enhancing service efficiency and sustainability. As the market adapts to regulatory changes, companies are likely to innovate, ensuring compliance while meeting growing service demands.

Asia-Pacific : Rapidly Growing Market Potential

The Asia-Pacific region is emerging as a significant player in the Offshore Rig Maintenance Services Market, with a market size of 1.5 in 2024. The growth is primarily driven by increasing offshore exploration activities, particularly in countries like China and India. The demand for maintenance services is also supported by rising investments in energy infrastructure and a growing focus on safety and efficiency in operations, making this region a focal point for future growth. Countries such as Australia and Malaysia are also contributing to the market's expansion, with local and international players vying for market share. Companies like Nabors Industries and EnscoRowan are actively involved in the region, enhancing their service offerings to cater to the growing demand. As the market matures, competition is expected to intensify, leading to innovations in service delivery and operational efficiency.

Middle East and Africa : Resource-Rich Frontier

The Middle East and Africa region, with a market size of 0.75 in 2024, presents a unique opportunity for growth in the Offshore Rig Maintenance Services Market. The region's vast oil and gas reserves drive demand for maintenance services, particularly in countries like Saudi Arabia and the UAE. The increasing focus on operational efficiency and safety standards is propelling investments in maintenance solutions, creating a conducive environment for market expansion. Key players such as Baker Hughes and Schlumberger are actively involved in the region, leveraging their expertise to enhance service delivery. The competitive landscape is evolving, with local companies also entering the market, aiming to capture a share of the growing demand. As the region continues to develop its offshore capabilities, the potential for growth in maintenance services remains significant.