Offshore Oil Rig Equipment MRO Services Market Summary

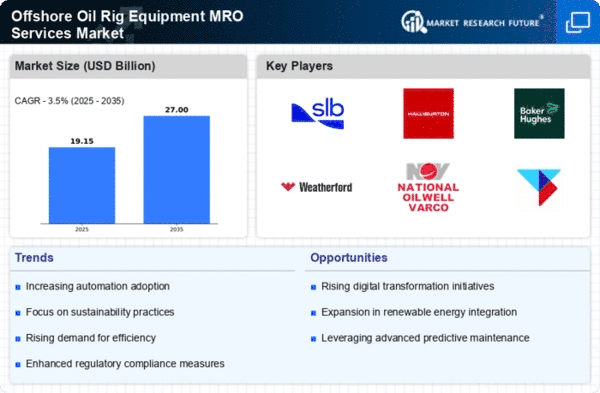

As per MRFR analysis, the Offshore Oil Rig Equipment MRO Services Market was estimated at 18.5 USD Billion in 2024. The Offshore Oil Rig Equipment MRO Services industry is projected to grow from 19.15 USD Billion in 2025 to 27.0 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.5 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Offshore Oil Rig Equipment MRO Services Market is poised for growth driven by technological advancements and sustainability initiatives.

- Technological integration is reshaping maintenance practices, enhancing efficiency and reliability.

- A strong focus on sustainability is influencing service offerings and operational practices across the sector.

- Collaborative partnerships are emerging as key strategies to optimize resource utilization and service delivery.

- The increasing demand for oil and gas, coupled with regulatory compliance, drives the need for preventive maintenance and overhaul services.

Market Size & Forecast

| 2024 Market Size | 18.5 (USD Billion) |

| 2035 Market Size | 27.0 (USD Billion) |

| CAGR (2025 - 2035) | 3.5% |

Major Players

Schlumberger (US), Halliburton (US), Baker Hughes (US), Weatherford International (US), National Oilwell Varco (US), TechnipFMC (GB), Aker Solutions (NO), Saipem (IT), Subsea 7 (GB)