Leading market players are Konecranes is interested in all technologies and solutions that help us serve our customers better and that can be integrated to Konecrane's business processes or offering. The most visible parts of the Konecranes startup collaboration are Konecranes REACH Program for Startups, our own startup program, and partnership with Maria 01, the Nordic’s leading startup market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Offshore Cranes industry must offer cost-effective items.

Huisman design, manufacture and service heavy construction equipment for the world’s leading companies in the renewable energy, oil and gas, civil, naval and entertainment markets. Our products range from Cranes, Offshore Wind Tools, Pipelay and Drilling Equipment to specials

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Offshore Cranes industry to benefit clients and increase the market sector. In recent years, the Offshore Cranes industry has offered some of the most significant advantages to medicine.

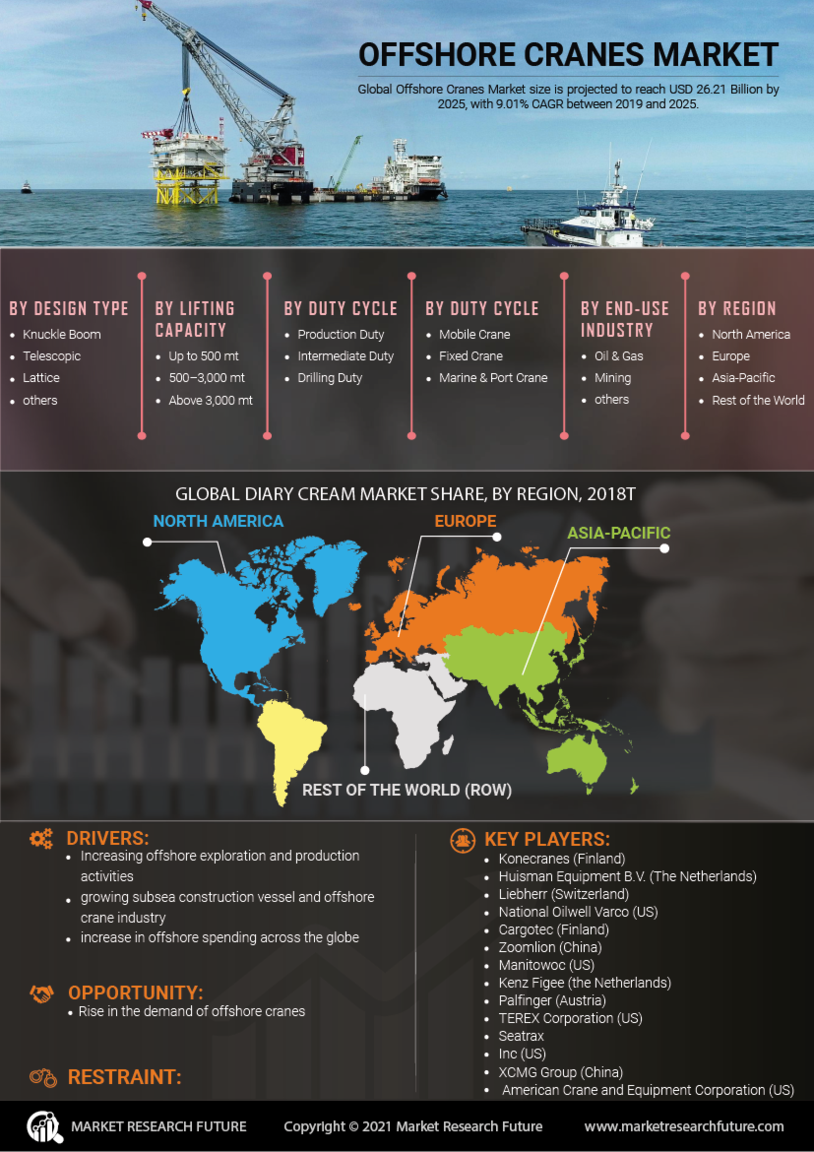

Major players in the Offshore Cranes Market, including Konecranes (Finland), Huisman Equipment B.V. (The Netherlands), Liebherr (Switzerland), National Oilwell Varco (US), Cargotec (Finland), Zoomlion (China), Manitowoc (US), KenzFigee ((The Netherlands), Palfinger (Austria), TEREX Corporation (US), Seartraxinc (US), XCMG Group (China), American Crane and Equipment Corporation (US), and others, are attempting to increase market demand by investing in research and development operations.

NOV's two main predecessors, Oilwell Supply and National Supply, were founded in 1862 and 1893, respectively. These two companies manufactured and distributed pumps and derricks. In 1930, United States Steel acquired Oilwell Supply. In 1958, Armco Steel merged with National Supply. In 1987, National Supply merged with USS Oilwell to become "National Oilwell". Varco was founded as Abegg and Reinhold Company by Walter Abegg and Baldwin Reinhold in 1908. "VARCO" is an acronym for: Vuilleumiere, Abegg and Reinhold Company after Edgar Vuilleumiere became a partner in 1915, and Varco International in 1973.

In 2000, National Oilwell merged with IRI International Corp., founded and managed by Hushang Ansary, which manufactures and sells drilling rigs and specialty steel products. The company acquired major drill pipe and drill bit manufacturer Grant Prideco in 2008 for $7.37 billion. At the time, Grant Prideco held 60% of the global drill pipe market and operated 25 manufacturing sites worldwide. The acquisition included Grant Prideco's subsidiaries IntelliServ, a producer of drill pipe with built-in equipment to transmit data from a wellhead to surface operators, ReedHycalog, a drill bit producer, and XL Systems, a producer of oil and gas connectors.

Grant Prideco, IntelliServ, and ReedHycalog became part of NOV's Wellbore Technologies reporting segment and XL Systems joined the Completion & Production Solutions segment. In February 2012 NOV acquired Russian coring company Interval Ltd. and purchased Dutch oil rig design company GustoMSC in 2018. GustoMSC, originally the engineering office of Gusto Shipyard, became part of NOV's Rig Technologies segment. In late 2019, NOV bought Bellingham, Washington-based Ershigs, a fabricator of custom pipes and tanks.

Zoomlion Heavy Industry Science and Technology Co., Ltd. is a Chinese construction machinery and agricultural machinery manufacturer. Its headquarters are in the Zoomlion Science Park in Changsha, Hunan, China. Zoomlion is China's largest and world's fifth largest construction machinery enterprise. Founded in 1992 as Changsha Hi-tech Development Area Zoomlion Construction Mechanical Industry Company, one of its first products were concrete pumps.

The company grew out of a subsidiary founded in 1956 in Beijing, as part of the first Ministry of Machinery Industry, Ministry of Construction, Central Enterprise Work Committee. Early development included the merging of several smaller, preexisting entities with Zoomlion including the former Concrete Machinery Research Office and remnants of the Changsha Construction Machinery Research Institute.

In August Zoomlion purchased a majority share in the agricultural machinery maker Chery Heavy Industry. Zoomlion purchased 60 percent of the company for 2.08 billion yuan.

With this acquisition Zoomlion intended to modernize China's agricultural machinery industry and compete with foreign brands that still dominate a big part of the medium and high-end large farm machinery market in China.