Rising Demand for Renewable Energy

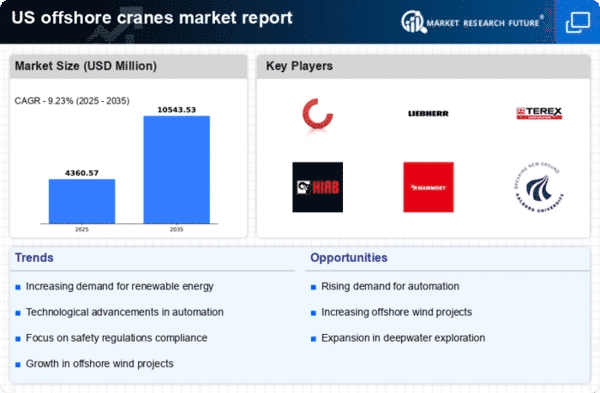

The offshore cranes market is experiencing a notable surge in demand driven by the increasing focus on renewable energy sources, particularly offshore wind farms. As the U.S. government aims to achieve 30 GW of offshore wind capacity by 2030, the need for specialized cranes to install and maintain wind turbines becomes critical. This shift towards renewable energy not only supports environmental goals but also stimulates job creation in the offshore sector. The offshore cranes market is likely to benefit from this trend, as companies invest in advanced lifting solutions to meet the growing requirements of the renewable energy sector.

Growing Focus on Safety Regulations

The offshore cranes market is being shaped by a growing focus on safety regulations and standards within the industry. As safety becomes a paramount concern, companies are compelled to invest in cranes that comply with stringent safety guidelines. This trend is particularly evident in the offshore oil and gas sector, where the risks associated with lifting operations are significant. Compliance with safety regulations not only protects workers but also enhances operational efficiency. Consequently, the offshore cranes market is likely to see an increase in demand for cranes that meet or exceed safety standards, driving innovation and development in the sector.

Expansion of Oil and Gas Exploration

The offshore cranes market is significantly influenced by the expansion of oil and gas exploration activities in U.S. waters. With the increasing demand for energy, companies are investing in offshore drilling projects, which require advanced crane systems for the installation and maintenance of drilling rigs and platforms. According to recent estimates, the offshore oil and gas sector is projected to grow at a CAGR of 5.2% through 2027, indicating a robust market for offshore cranes. This growth is likely to drive innovation and competition among crane manufacturers, enhancing the overall capabilities of the offshore cranes market.

Technological Innovations in Crane Design

Technological innovations are reshaping the offshore cranes market, as manufacturers develop advanced crane systems that enhance efficiency and safety. Innovations such as automated crane operations, real-time monitoring systems, and improved load management capabilities are becoming increasingly prevalent. These advancements not only reduce operational costs but also minimize the risk of accidents, which is crucial in the offshore environment. As companies seek to optimize their operations, the demand for technologically advanced cranes is expected to rise, further propelling the offshore cranes market forward.

Increased Investment in Infrastructure Development

The offshore cranes market is poised for growth due to increased investment in infrastructure development, particularly in coastal regions. The U.S. government has allocated substantial funding for upgrading port facilities and offshore infrastructure, which necessitates the use of advanced cranes for construction and maintenance. This investment is expected to create a favorable environment for the offshore cranes market, as companies seek to enhance their operational capabilities. Furthermore, the integration of modern crane technology into infrastructure projects is likely to improve efficiency and safety, thereby attracting more investments in the sector.