Research Methodology on Offshore Wind Market

Abstract

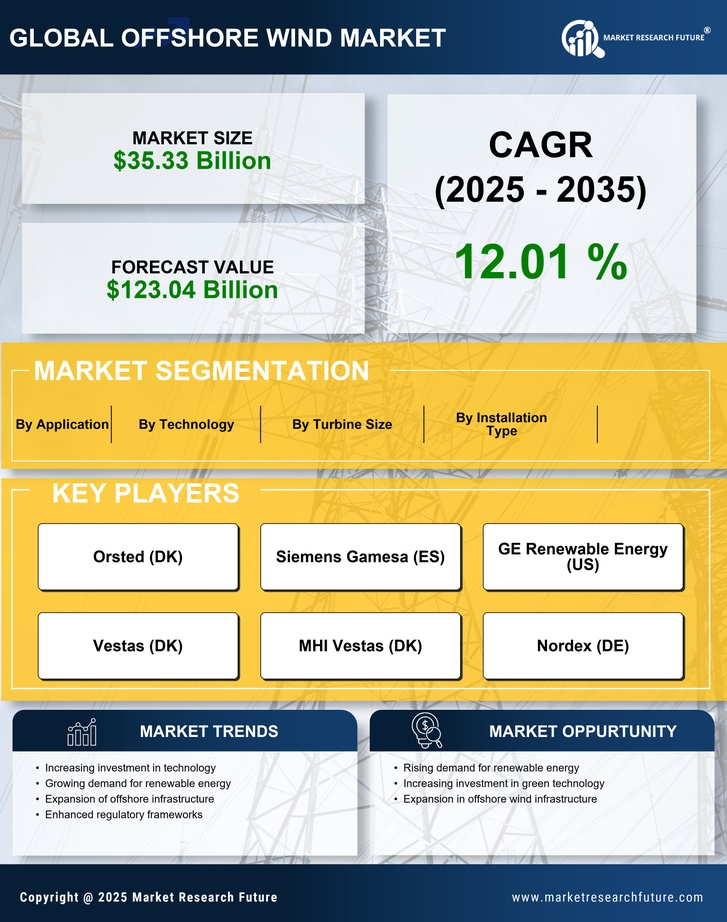

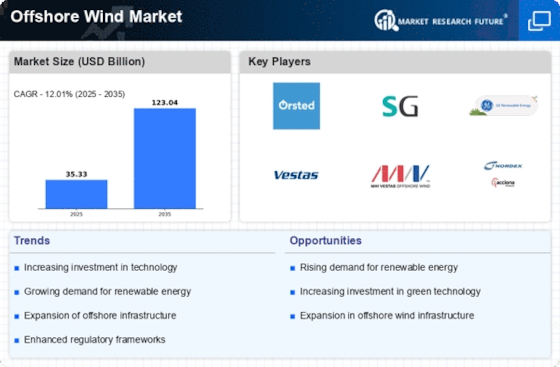

This study aims to provide an in-depth analysis of the Offshore Wind Market and to provide insights into key market trends, drivers, and strategies. Primary data are collected from industry experts through interviews and secondary data are sourced from industry databases and journals. The findings of the study indicate healthy growth in the coming years due to increasing investments in offshore wind projects, increasing energy demands, and the development of innovative technologies.

Introduction

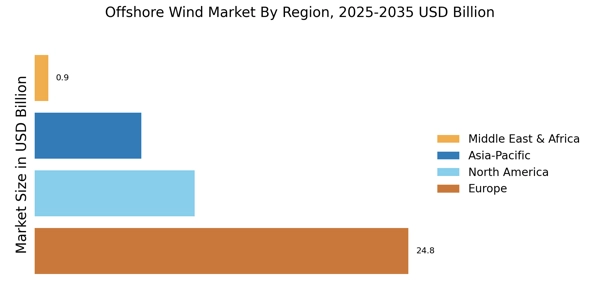

Offshore wind is a form of wind energy derived from the wind blowing over the oceans, seas, and lakes. It is one of the key approaches to harnessing renewable energy sources. Offshore wind can meet the energy demands of the growing global population sustainably and cost-effectively, hence the demand for offshore wind energy is continuously increasing globally. With increasing energy demands and technological advancements, the global offshore wind energy industry is expected to witness significant growth over the forecast period 2023 to 2030.

Research Methodology

The published research report attempts to study the ongoing trend in the offshore wind energy industry, as well as the drivers and restraints of the industry, and the future outlook. The data for this study is collected from secondary sources such as industry databases, reports, journals and websites. Data is also collected through primary sources such as interviews with subject matter experts and surveys with stakeholders in the offshore wind energy industry.

The research design adopted for this study is a qualitative approach and includes both primary and secondary sources of data. The primary data is collected from industry experts through interviews and surveys. The secondary data is collected by analyzing various sources of information such as industry reports, journals, and databases of various countries. The data thus collected is collated and analyzed using statistical methods such as descriptive statistics, linear regression, and factor analysis.

Data Analysis

The findings of the study indicate healthy growth in the coming years due to increasing investments in offshore wind projects, increasing energy demands, and the development of innovative technologies. The driving factors of the offshore wind energy industry include increasing global energy demands, government incentives, technological advancements, and costs of energy production. In addition, the key constraints include limited access to offshore sites, reliability of power generation, and an uncertain investment environment.

Conclusion

To conclude, the offshore wind energy industry is witnessing significant growth due to increasing global energy demands, government incentives, technological advancements, and decreasing costs of energy production. The major restraining factors limiting this growth are limited access to the offshore sites, an uncertain investment environment, and lower power output than expected.