Nutrition Chemicals Market Summary

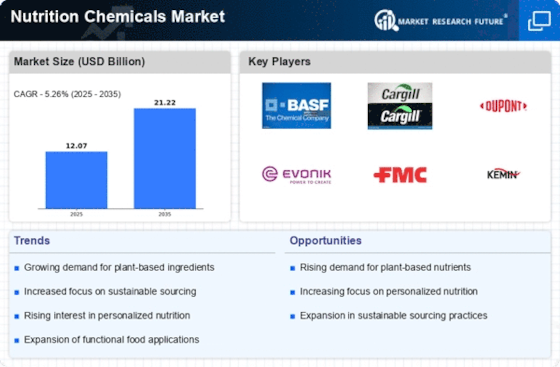

As per Market Research Future analysis, the Nutrition Chemicals Market Size was estimated at 12.07 USD Billion in 2024. The Nutrition Chemicals industry is projected to grow from 12.71 USD Billion in 2025 to 21.22 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.26% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Nutrition Chemicals Market is experiencing a dynamic shift towards sustainability and personalized solutions.

- The rise of plant-based ingredients is reshaping product formulations across various sectors.

- Personalized nutrition is gaining traction, driven by consumer demand for tailored dietary solutions.

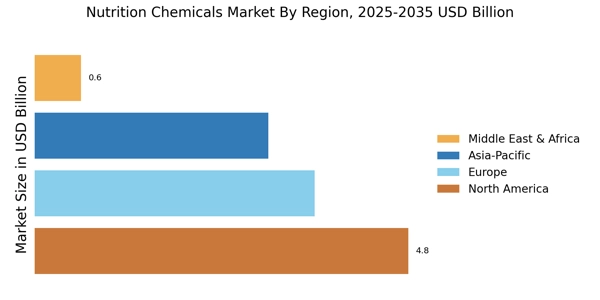

- Sustainability initiatives are becoming increasingly central to product development in North America and Asia-Pacific.

- The market is propelled by rising health awareness and technological advancements in food processing, particularly in the liquid and pharmaceuticals segments.

Market Size & Forecast

| 2024 Market Size | 12.07 (USD Billion) |

| 2035 Market Size | 21.22 (USD Billion) |

| CAGR (2025 - 2035) | 5.26% |

Major Players

BASF SE (DE), Cargill, Incorporated (US), DuPont de Nemours, Inc. (US), Evonik Industries AG (DE), FMC Corporation (US), Kemin Industries, Inc. (US), Nutrien Ltd. (CA), Royal DSM N.V. (NL), Syngenta AG (CH), Tate & Lyle PLC (GB)