Rising Health Consciousness

The increasing awareness of health and wellness among consumers is a primary driver for the Global Nutraceutical Excipients Market Industry. As individuals become more health-conscious, there is a growing demand for dietary supplements and functional foods that enhance health. This trend is reflected in the projected market value of 2.58 USD Billion in 2024, indicating a robust interest in nutraceutical products. Consumers are actively seeking natural ingredients and formulations that support their health goals, which in turn drives the need for effective excipients that enhance the bioavailability and stability of these products.

Expansion of E-commerce Platforms

The rapid expansion of e-commerce platforms is transforming the Global Nutraceutical Excipients Market Industry. Online retailing provides consumers with greater access to a diverse range of nutraceutical products, facilitating informed purchasing decisions. This trend is particularly relevant as consumers increasingly seek convenience and variety in their health products. The growth of e-commerce is expected to drive the market further, as it allows for the introduction of innovative excipients that cater to online consumers. As the market continues to evolve, the integration of digital platforms is likely to enhance the visibility and accessibility of nutraceutical excipients.

Regulatory Support for Nutraceuticals

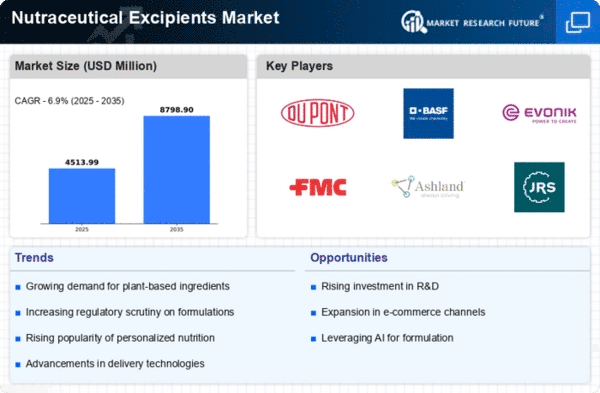

Supportive regulatory frameworks are fostering growth in the Global Nutraceutical Excipients Market Industry. Governments worldwide are increasingly recognizing the importance of nutraceuticals in public health, leading to the establishment of guidelines that promote their safe use. This regulatory backing encourages manufacturers to invest in research and development, ultimately expanding the range of available excipients. As the market evolves, the anticipated compound annual growth rate of 5.19% from 2025 to 2035 suggests a favorable environment for the growth of nutraceutical excipients, driven by enhanced product safety and efficacy.

Growing Demand for Plant-Based Excipients

The shift towards plant-based ingredients is reshaping the Global Nutraceutical Excipients Market Industry. Consumers are increasingly favoring products that align with their values regarding sustainability and health. This trend is evident in the rising demand for plant-derived excipients, which are perceived as safer and more natural alternatives to synthetic options. As the market adapts to these preferences, manufacturers are likely to innovate and develop new plant-based excipients that meet consumer expectations. This shift not only supports market growth but also aligns with broader trends in the food and beverage industry towards cleaner labels and transparency.

Technological Advancements in Formulation

Technological innovations in the formulation of nutraceuticals are significantly influencing the Global Nutraceutical Excipients Market Industry. Advances in encapsulation techniques, for example, allow for improved delivery systems that enhance the effectiveness of active ingredients. This evolution in formulation technology is expected to contribute to the market's growth, with a projected increase to 4.5 USD Billion by 2035. Such advancements not only improve product efficacy but also cater to consumer preferences for convenience and ease of use, thereby expanding the market for excipients that facilitate these innovations.