Regulatory Pressures and Compliance

Regulatory frameworks governing biopharmaceuticals are becoming increasingly stringent, impacting the Biopharmaceutical Excipients Market. Compliance with these regulations necessitates the use of high-quality excipients that meet safety and efficacy standards.

As regulatory bodies emphasize the importance of quality assurance, manufacturers are compelled to invest in excipients that not only comply with these regulations but also enhance the overall quality of biopharmaceutical products. This trend is likely to drive innovation and growth within the excipients market.

Innovations in Drug Delivery Systems

Advancements in drug delivery technologies are significantly influencing the Biopharmaceutical Excipients Market. Innovations such as nanotechnology and targeted delivery systems are enhancing the effectiveness of biopharmaceuticals.

These technologies require specialized excipients that can improve solubility, stability, and bioavailability of active pharmaceutical ingredients. The market for excipients tailored for these advanced delivery systems is expected to witness substantial growth, as pharmaceutical companies increasingly seek to optimize their formulations to meet patient needs and regulatory standards.

Rising Demand for Biopharmaceuticals

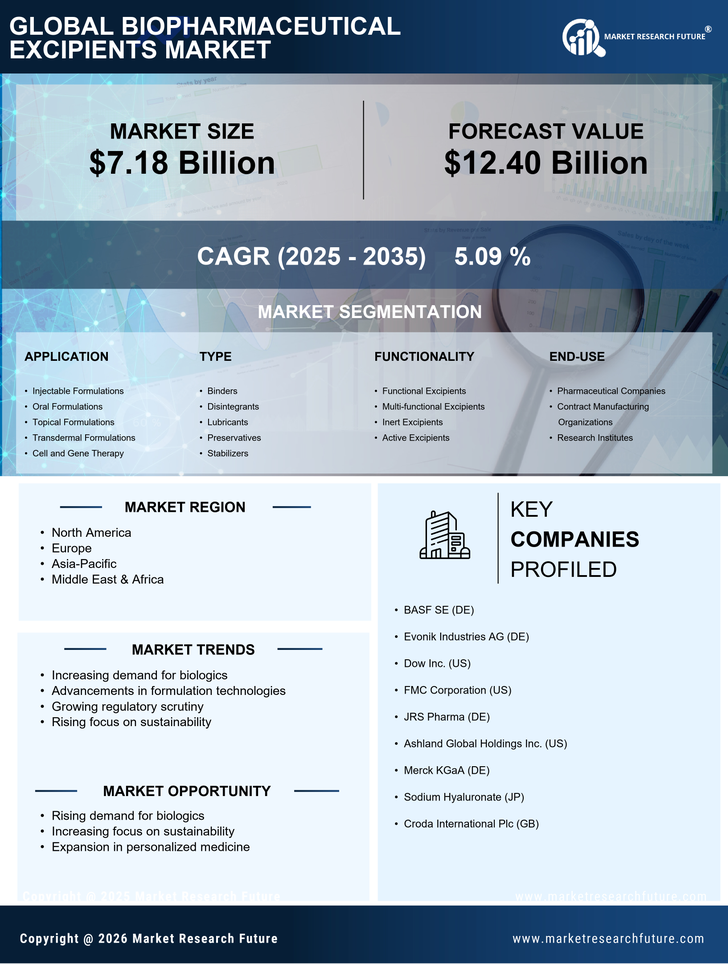

The increasing prevalence of chronic diseases and the aging population are driving the demand for biopharmaceuticals. This trend is expected to bolster the Biopharmaceutical Excipients Market, as excipients play a crucial role in the formulation and stability of biopharmaceutical products.

According to recent estimates, the biopharmaceutical sector is projected to grow at a compound annual growth rate of over 8% in the coming years. This growth is likely to create a corresponding demand for excipients that enhance drug delivery and efficacy, thereby expanding the market for biopharmaceutical excipients.

Increased Focus on Personalized Medicine

The shift towards personalized medicine is reshaping the Biopharmaceutical Excipients Market. As therapies become more tailored to individual patient profiles, the demand for excipients that can accommodate diverse formulations is likely to rise.

This trend is supported by the growing number of biopharmaceuticals entering the market, which often require unique excipient profiles to ensure efficacy and safety. The market for excipients that facilitate personalized therapies is anticipated to expand, reflecting the broader movement towards customized healthcare solutions.

Sustainability Initiatives in Pharmaceutical Manufacturing

The growing emphasis on sustainability in pharmaceutical manufacturing is influencing the Biopharmaceutical Excipients Market. Companies are increasingly seeking excipients derived from renewable sources or those that minimize environmental impact.

This shift towards sustainable practices is not only driven by regulatory requirements but also by consumer demand for environmentally friendly products. As a result, the market for sustainable excipients is expected to grow, reflecting a broader commitment to sustainability within the biopharmaceutical sector.