Increased Safety Regulations

The Nuclear Robot Market is significantly influenced by the tightening of safety regulations across various regions. Governments and regulatory bodies are implementing stringent guidelines to ensure the safe handling of nuclear materials and waste. This regulatory environment is compelling nuclear facilities to adopt robotic solutions that can operate in high-risk areas, thereby minimizing human exposure to radiation. The market for nuclear robots is expected to grow at a compound annual growth rate of 8% over the next five years, driven by the need for compliance with these regulations. Consequently, the demand for advanced robotic systems that meet safety standards is likely to rise, further propelling the Nuclear Robot Market.

Rising Investment in Nuclear Energy

The Nuclear Robot Market is benefiting from a resurgence in investment in nuclear energy as countries seek to diversify their energy sources. This renewed interest is driven by the need for cleaner energy alternatives and the desire to reduce carbon emissions. As nuclear facilities expand and modernize, the demand for robotic solutions to enhance operational efficiency and safety is likely to increase. Reports indicate that investments in nuclear energy could exceed USD 100 billion by 2030, creating a favorable environment for the Nuclear Robot Market. The integration of robotics in nuclear operations is expected to play a crucial role in meeting energy demands while ensuring safety.

Emerging Markets and Global Expansion

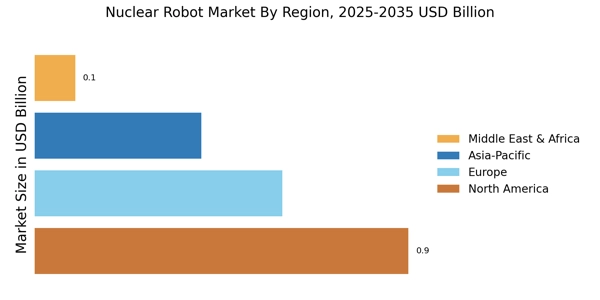

The Nuclear Robot Market is poised for growth due to the emergence of new markets and the expansion of existing ones. Countries that are developing their nuclear capabilities are increasingly recognizing the importance of robotic technologies in enhancing safety and efficiency. As nations invest in nuclear infrastructure, the demand for advanced robotic systems is likely to rise. Emerging markets in Asia and Eastern Europe are particularly noteworthy, as they are projected to contribute significantly to the market's growth. The Nuclear Robot Market may see a compound annual growth rate of 7% in these regions, driven by the need for innovative solutions to address the challenges of nuclear operations.

Technological Advancements in Robotics

The Nuclear Robot Market is experiencing a surge in technological advancements, particularly in robotics. Innovations in artificial intelligence and machine learning are enhancing the capabilities of nuclear robots, allowing for more precise operations in hazardous environments. For instance, the integration of advanced sensors and automation technologies is enabling robots to perform complex tasks with minimal human intervention. This trend is reflected in the increasing investment in research and development, which is projected to reach USD 1.5 billion by 2026. As these technologies evolve, they are likely to improve the efficiency and safety of nuclear operations, thereby driving growth in the Nuclear Robot Market.

Growing Demand for Decommissioning Services

The Nuclear Robot Market is witnessing a growing demand for decommissioning services as aging nuclear facilities require safe dismantling. The decommissioning process involves complex tasks that pose significant risks to human workers, making robotic solutions increasingly attractive. According to industry estimates, the decommissioning market is expected to reach USD 4 billion by 2027, with a substantial portion allocated to robotic technologies. These robots are designed to handle hazardous materials and perform tasks such as cutting, dismantling, and waste management. As the need for efficient and safe decommissioning escalates, the Nuclear Robot Market is poised for substantial growth.