Growing E-commerce Sector

The rapid expansion of the e-commerce sector significantly influences the Global Mobile Robotics Market Industry. As online shopping continues to gain popularity, logistics and warehousing operations are increasingly adopting mobile robots to streamline order fulfillment processes. These robots facilitate efficient inventory management and last-mile delivery, addressing the growing consumer demand for faster service. The integration of mobile robotics in e-commerce operations not only enhances efficiency but also reduces labor costs. This trend is expected to contribute to the market's growth, aligning with the projected increase in market value to 150 USD Billion by 2035, reflecting the sector's evolving dynamics.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global Mobile Robotics Market Industry. Innovations in artificial intelligence, machine learning, and sensor technologies enhance the capabilities of mobile robots, enabling them to navigate complex environments and perform intricate tasks. For instance, advancements in computer vision allow robots to identify and interact with objects more effectively. These developments not only improve the functionality of mobile robots but also expand their applications across diverse sectors. As technology continues to evolve, the market is expected to witness an influx of sophisticated robotic solutions, contributing to a projected market growth to 150 USD Billion by 2035.

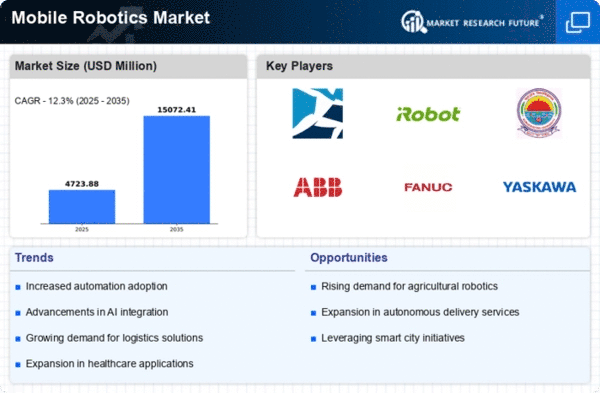

Rising Demand for Automation

The Global Mobile Robotics Market Industry experiences a notable surge in demand for automation across various sectors, including manufacturing, logistics, and healthcare. As industries strive for enhanced efficiency and productivity, mobile robots are increasingly deployed to perform tasks such as material handling and delivery. This trend is supported by the projected market value of 49.0 USD Billion in 2024, indicating a robust growth trajectory. Companies are recognizing the potential of mobile robotics to reduce operational costs and improve service delivery, thereby driving investment in this technology. The ongoing shift towards automation is likely to propel the market further, as organizations seek to remain competitive.

Chart: Global Mobile Robotics Market Growth

This chart illustrates the projected growth trajectory of the Global Mobile Robotics Market Industry, highlighting key milestones such as the anticipated market value of 49.0 USD Billion in 2024 and the expected growth to 150 USD Billion by 2035. The chart also depicts the compound annual growth rate of 10.7% from 2025 to 2035, emphasizing the robust expansion of the market driven by various factors, including technological advancements and increased automation across industries.

Increased Investment in Research and Development

Investment in research and development is a critical driver for the Global Mobile Robotics Market Industry. Governments and private entities are allocating substantial resources to explore innovative robotic solutions that address specific industry challenges. This commitment to R&D fosters the development of advanced mobile robotics systems that can operate autonomously and efficiently. For example, various government initiatives aim to support the integration of robotics in sectors such as agriculture and healthcare, enhancing productivity and service quality. The anticipated compound annual growth rate of 10.7% from 2025 to 2035 underscores the importance of R&D in driving market expansion and technological progress.