Advancements in Robotics Technology

Technological advancements are playing a crucial role in shaping the US Mobile Robotics Market. Innovations in artificial intelligence, machine learning, and sensor technology are enhancing the capabilities of mobile robots, making them more efficient and versatile. For instance, the integration of advanced navigation systems allows robots to operate safely in dynamic environments, which is essential for applications in warehouses and retail settings. The market for mobile robotics is projected to reach approximately 10 billion dollars by 2026, driven by these technological improvements. As companies recognize the potential of mobile robots to transform operations, investment in research and development is likely to increase, further propelling the growth of the US Mobile Robotics Market.

Increased Focus on Safety and Compliance

Safety and compliance are becoming paramount in the US Mobile Robotics Market, particularly in sectors such as manufacturing and healthcare. As organizations strive to adhere to stringent safety regulations, mobile robots are being deployed to mitigate risks associated with human labor. For example, robots can perform hazardous tasks, reducing the likelihood of workplace accidents. The Occupational Safety and Health Administration (OSHA) has been actively promoting the use of automation to enhance workplace safety. This focus on safety is likely to drive the adoption of mobile robotics, as companies seek to comply with regulations while improving operational efficiency. Consequently, the US Mobile Robotics Market is expected to benefit from this heightened emphasis on safety and compliance.

Expansion of E-commerce and Last-Mile Delivery

The rapid expansion of e-commerce in the United States is significantly influencing the US Mobile Robotics Market. With online shopping becoming increasingly prevalent, logistics companies are under pressure to optimize their last-mile delivery processes. Mobile robots are emerging as a viable solution to address these challenges, offering efficient and cost-effective delivery options. Recent statistics indicate that the US e-commerce market is expected to reach over 1 trillion dollars by 2026, which could further propel the demand for mobile robotics in logistics. Companies are investing in autonomous delivery robots to enhance customer satisfaction and reduce delivery times. This trend suggests that the US Mobile Robotics Market will continue to grow as businesses seek innovative solutions to meet the evolving demands of consumers.

Growing Demand for Automation in Manufacturing

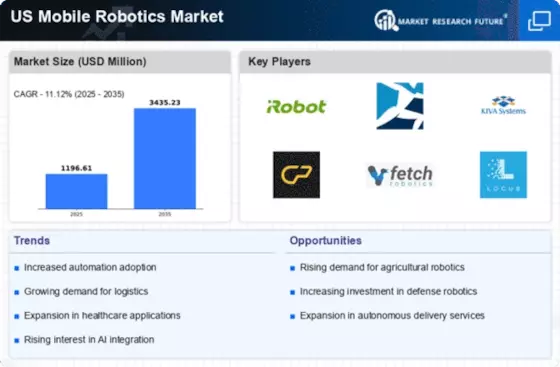

The US Mobile Robotics Market is experiencing a notable surge in demand for automation within the manufacturing sector. As companies strive to enhance productivity and reduce operational costs, mobile robots are increasingly being integrated into production lines. According to recent data, the manufacturing sector in the US is projected to grow at a compound annual growth rate of 3.5% through 2026. This growth is likely to drive the adoption of mobile robotics, as manufacturers seek to streamline processes and improve efficiency. Furthermore, the implementation of mobile robots can lead to a reduction in labor costs and an increase in output quality, making them an attractive investment for manufacturers. As a result, the US Mobile Robotics Market is poised for significant expansion, driven by the need for advanced automation solutions.

Rising Labor Shortages and Workforce Challenges

The US Mobile Robotics Market is being significantly influenced by rising labor shortages and workforce challenges across various sectors. As the labor market tightens, companies are increasingly turning to mobile robots to fill gaps in their workforce. This trend is particularly evident in industries such as warehousing and logistics, where the demand for labor has outpaced supply. According to recent reports, the US is projected to face a shortage of over 1 million warehouse workers by 2026. In response, businesses are investing in mobile robotics to automate repetitive tasks and enhance productivity. This shift not only addresses labor shortages but also allows companies to maintain operational efficiency. As a result, the US Mobile Robotics Market is likely to see continued growth as organizations adapt to these workforce challenges.