Rising Mineral Extraction Activities

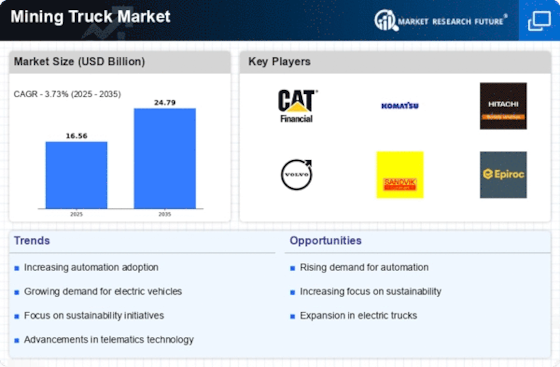

The Mining Truck Market is significantly influenced by the rising mineral extraction activities across various regions. As economies continue to develop, the demand for minerals such as copper, gold, and lithium has escalated. This increase in extraction activities necessitates the use of robust mining trucks that can handle the rigorous demands of transporting heavy loads. According to recent data, the mining sector is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This growth is likely to bolster the Mining Truck Market, as companies invest in modern fleets to meet the rising demand for minerals.

Technological Innovations in Mining Trucks

Technological innovations play a crucial role in shaping the Mining Truck Market. The introduction of autonomous mining trucks, equipped with advanced sensors and artificial intelligence, is revolutionizing the way mining operations are conducted. These innovations not only enhance safety by reducing human error but also improve efficiency by optimizing routes and load management. Furthermore, the integration of telematics systems allows for real-time monitoring of truck performance, leading to better maintenance and reduced downtime. As these technologies continue to evolve, they are expected to drive the Mining Truck Market towards greater efficiency and productivity.

Increased Demand for Efficient Mining Operations

The Mining Truck Market experiences a notable surge in demand for efficient mining operations. As mining companies strive to enhance productivity and reduce operational costs, the need for advanced mining trucks becomes paramount. These trucks are designed to transport large volumes of materials swiftly and safely, thereby optimizing the overall mining process. In recent years, the industry has seen a shift towards larger capacity trucks, with models capable of carrying over 400 tons per load. This trend indicates a growing preference for high-capacity vehicles that can operate in challenging terrains, ultimately driving the Mining Truck Market forward.

Expansion of Mining Operations in Emerging Markets

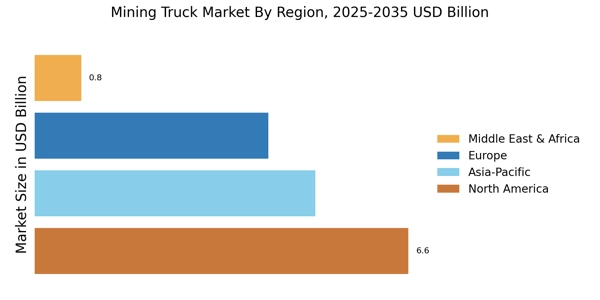

The Mining Truck Market is witnessing a notable expansion due to the growth of mining operations in emerging markets. Countries rich in natural resources are increasingly attracting investments in mining infrastructure, leading to a higher demand for mining trucks. This trend is particularly evident in regions such as Africa and South America, where untapped mineral reserves present significant opportunities for exploration and extraction. As these markets develop, the need for reliable and efficient mining trucks becomes critical. Consequently, the Mining Truck Market is poised for growth as manufacturers seek to capitalize on these emerging opportunities.

Environmental Regulations and Sustainability Initiatives

The Mining Truck Market is increasingly affected by stringent environmental regulations and sustainability initiatives. Governments and regulatory bodies are imposing stricter emissions standards, prompting mining companies to invest in cleaner and more efficient trucks. This shift towards sustainability is not merely a compliance measure; it is also a strategic move to enhance corporate reputation and operational efficiency. Many companies are now exploring electric and hybrid mining trucks as viable alternatives to traditional diesel-powered vehicles. This transition is likely to reshape the Mining Truck Market, as manufacturers innovate to meet the evolving demands of environmentally conscious consumers.