North America : Market Leader in Services

North America is poised to maintain its leadership in the Mining Truck Fleet Maintenance and Repair Services Market, holding a market size of $2.6 billion in 2025. Key growth drivers include the increasing demand for efficient mining operations, stringent safety regulations, and technological advancements in fleet management. The region's robust infrastructure and investment in mining activities further bolster market growth, making it a focal point for service providers.

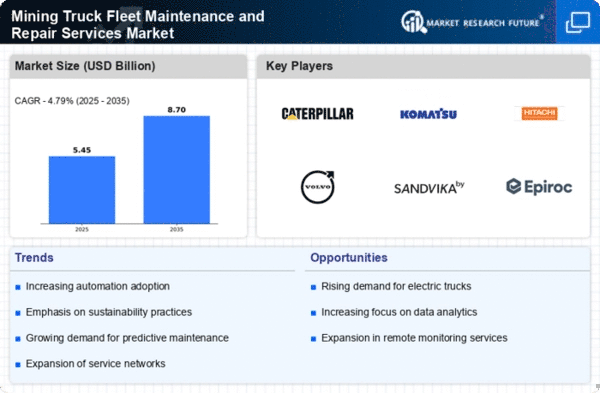

The competitive landscape is characterized by major players such as Caterpillar Inc, Terex Corporation, and Volvo Group, which dominate the market with innovative solutions and extensive service networks. The U.S. and Canada are the leading countries, benefiting from advanced mining technologies and a strong regulatory framework that supports operational efficiency. This competitive environment fosters continuous improvement and adaptation to market needs.

Europe : Emerging Market Dynamics

Europe's Mining Truck Fleet Maintenance and Repair Services Market is projected to reach $1.3 billion by 2025, driven by increasing mining activities and a focus on sustainability. Regulatory frameworks promoting environmental responsibility and safety standards are key catalysts for growth. The demand for advanced maintenance solutions is rising as companies seek to enhance operational efficiency and reduce downtime, positioning Europe as a significant player in the global market.

Leading countries such as Germany, Sweden, and Finland are at the forefront, supported by key players like Sandvik AB and Atlas Copco AB. The competitive landscape is evolving, with companies investing in innovative technologies and partnerships to meet the growing demand. The presence of established firms and a skilled workforce further strengthens the region's market position.

Asia-Pacific : Rapid Growth and Innovation

The Asia-Pacific region is witnessing significant growth in the Mining Truck Fleet Maintenance and Repair Services Market, projected to reach $1.5 billion by 2025. Key drivers include increasing mining operations, urbanization, and the demand for advanced maintenance technologies. Countries like China and Australia are leading the charge, supported by favorable government policies and investments in infrastructure, which are crucial for market expansion.

The competitive landscape features major players such as Komatsu Ltd and Hitachi Construction Machinery, which are leveraging technological advancements to enhance service offerings. The region's diverse mining activities and the presence of established companies create a dynamic environment for growth. As demand for efficient and reliable services rises, the market is expected to flourish in the coming years.

Middle East and Africa : Emerging Opportunities Ahead

The Middle East and Africa region is gradually emerging in the Mining Truck Fleet Maintenance and Repair Services Market, with a projected size of $0.8 billion by 2025. The growth is driven by increasing investments in mining infrastructure and a rising demand for efficient maintenance solutions. Regulatory support for mining activities and a focus on local resource utilization are key factors contributing to market development in this region.

Countries like South Africa and the UAE are leading the market, with a growing presence of key players such as Epiroc AB and Terex Corporation. The competitive landscape is evolving, with companies focusing on innovative service solutions to meet the unique challenges of the region. As mining activities expand, the demand for maintenance and repair services is expected to rise significantly, presenting new opportunities for growth.