Environmental Regulations

The Autonomous Mining Truck Market is influenced by the increasing stringency of environmental regulations. Governments are implementing stricter guidelines aimed at reducing the environmental impact of mining operations. Autonomous trucks, which are often designed to be more fuel-efficient and produce lower emissions, align well with these regulatory requirements. The adoption of such technology can help mining companies comply with environmental standards while also improving their public image. As regulatory pressures mount, the shift towards autonomous solutions appears to be a proactive approach for companies aiming to meet compliance and sustainability goals. This trend is expected to drive further investment in autonomous mining technologies.

Labor Shortages in Mining

The Autonomous Mining Truck Market is also being driven by the persistent labor shortages faced by the mining sector. Many regions are experiencing difficulties in attracting and retaining skilled labor, which has prompted mining companies to seek automation solutions. Autonomous trucks can mitigate the impact of labor shortages by performing tasks that would typically require human operators. This shift not only addresses the immediate labor challenges but also enhances safety by reducing the number of personnel required in hazardous environments. As the industry grapples with these labor issues, the adoption of autonomous trucks is likely to become a more attractive option for companies looking to maintain productivity and safety standards.

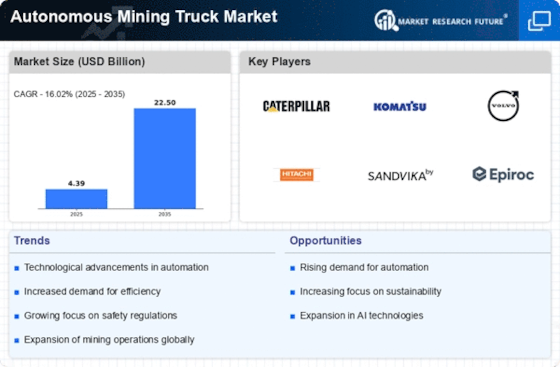

Technological Innovations

Technological advancements play a pivotal role in the growth of the Autonomous Mining Truck Market. Innovations in artificial intelligence, machine learning, and sensor technologies have significantly enhanced the capabilities of autonomous trucks. These trucks are now equipped with advanced navigation systems and real-time data processing, enabling them to operate safely and efficiently in complex mining environments. The integration of these technologies has led to a notable increase in the adoption rate of autonomous trucks, with projections indicating a compound annual growth rate of over 15% in the coming years. As mining operations become more reliant on technology, the demand for autonomous solutions is likely to continue its upward trajectory.

Cost Reduction Initiatives

Cost reduction remains a primary focus within the Autonomous Mining Truck Market. Mining companies are under constant pressure to lower operational costs while maintaining productivity. Autonomous trucks offer a viable solution by minimizing labor costs and reducing the likelihood of human error, which can lead to costly accidents and downtime. The initial investment in autonomous technology is often offset by long-term savings, making it an appealing option for many operators. Recent analyses suggest that companies can achieve a return on investment within a few years of adopting autonomous trucks. As the industry continues to seek ways to enhance profitability, the trend towards automation is likely to gain momentum.

Increased Demand for Efficiency

The Autonomous Mining Truck Market is experiencing a surge in demand for enhanced operational efficiency. Mining companies are increasingly adopting autonomous trucks to optimize their logistics and reduce operational costs. These trucks can operate continuously without the need for breaks, leading to increased productivity. According to recent data, autonomous trucks can improve efficiency by up to 30% compared to traditional trucks. This efficiency not only translates to cost savings but also allows for better resource management, which is crucial in the competitive mining sector. As companies strive to maximize output while minimizing expenses, the adoption of autonomous trucks appears to be a strategic move that aligns with their operational goals.