Government Incentives and Support

Government policies and incentives are significantly influencing the Electric Drive Mining Truck Market. Many governments are implementing initiatives to promote the adoption of electric vehicles, including tax breaks, grants, and subsidies for companies investing in electric mining trucks. These incentives not only lower the initial investment costs but also encourage mining companies to transition from traditional diesel-powered trucks to electric alternatives. Recent reports indicate that countries with robust support frameworks are witnessing accelerated growth in electric vehicle adoption, which is expected to extend to the mining sector, thereby bolstering the market.

Rising Fuel Prices and Operational Costs

The Electric Drive Mining Truck Market is also being driven by the rising fuel prices and operational costs associated with traditional mining trucks. As fuel prices continue to fluctuate, mining companies are increasingly looking for cost-effective alternatives. Electric drive trucks, which have lower energy costs compared to diesel trucks, present a viable solution. Data suggests that electric trucks can reduce operational costs by up to 30% over their lifespan, making them an attractive option for mining operations. This economic advantage is likely to accelerate the shift towards electric drive solutions in the industry.

Growing Focus on Safety and Worker Health

Safety and worker health considerations are becoming increasingly prominent in the Electric Drive Mining Truck Market. Electric drive mining trucks are designed to operate with reduced noise and vibration levels, which can enhance the working environment for operators. Additionally, the absence of harmful emissions contributes to better air quality in mining sites, promoting overall worker health. As mining companies prioritize safety and health standards, the adoption of electric trucks is expected to rise. This trend not only aligns with corporate social responsibility goals but also helps in attracting and retaining skilled labor in the industry.

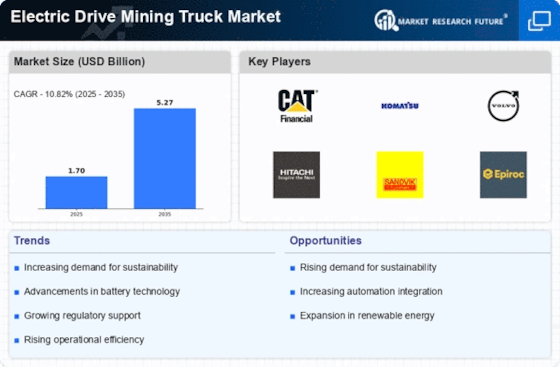

Increased Demand for Sustainable Mining Solutions

The Electric Drive Mining Truck Market is experiencing a notable surge in demand for sustainable mining solutions. As environmental concerns intensify, mining companies are increasingly seeking to reduce their carbon footprints. Electric drive mining trucks, which produce zero emissions during operation, align with these sustainability goals. According to recent data, the mining sector is projected to invest significantly in electric vehicles, with estimates suggesting a potential market growth rate of over 20% annually. This shift towards electrification not only addresses environmental regulations but also enhances operational efficiency, making electric drive trucks a preferred choice in the industry.

Technological Innovations in Electric Drive Systems

Technological advancements play a crucial role in the Electric Drive Mining Truck Market. Innovations in battery technology, electric motors, and energy management systems are enhancing the performance and efficiency of electric mining trucks. For instance, the introduction of high-capacity lithium-ion batteries has improved the range and operational time of these vehicles. Furthermore, advancements in automation and connectivity are enabling real-time monitoring and predictive maintenance, which can reduce downtime and operational costs. As these technologies continue to evolve, they are likely to drive further adoption of electric drive trucks in mining operations.