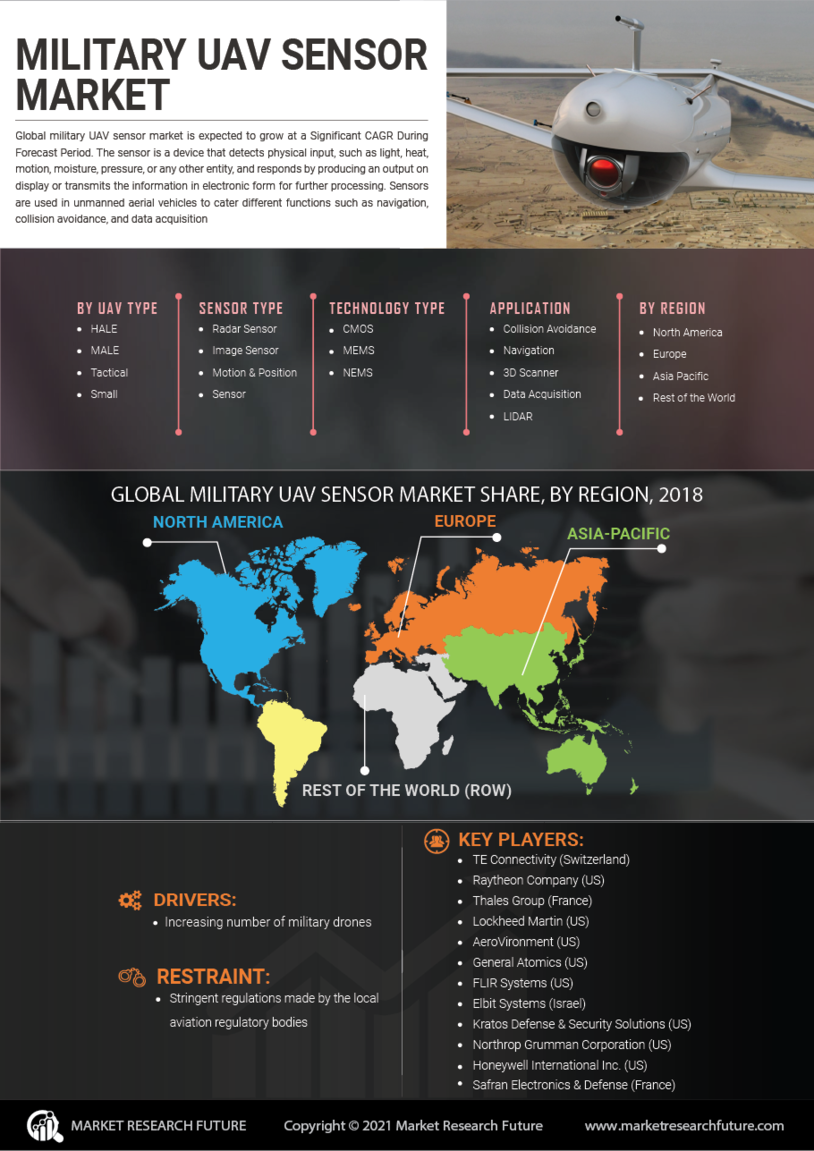

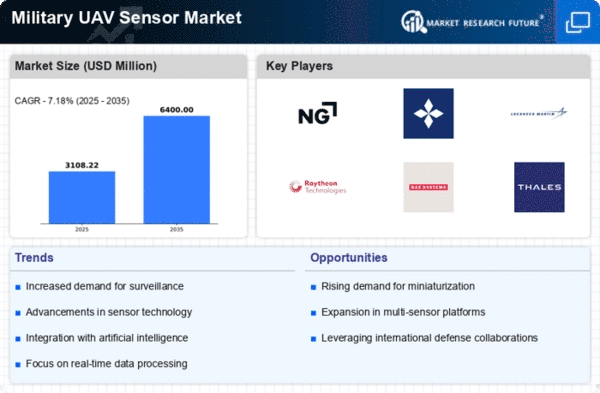

Market Growth Projections

The Global Military UAV Sensor Industry is projected to experience substantial growth over the next decade. With a market value expected to reach 2.03 USD Billion in 2024 and an anticipated increase to 3.99 USD Billion by 2035, the industry is poised for significant expansion. The compound annual growth rate (CAGR) of 6.34% from 2025 to 2035 indicates a robust demand for UAV sensors driven by technological advancements and increasing military expenditures. This growth reflects the ongoing evolution of military strategies and the critical role that UAV sensors play in modern warfare.

Increasing Military Expenditure

The Global Military UAV Sensor Industry is experiencing growth driven by rising military budgets across various nations. Countries are investing heavily in advanced technologies to enhance their defense capabilities. For instance, in 2024, military spending is projected to reach approximately 2.03 USD Billion, reflecting a commitment to modernizing military assets. This trend is likely to continue, as nations recognize the strategic advantages offered by UAV sensors in surveillance and reconnaissance missions. As military expenditure increases, the demand for sophisticated UAV sensors is expected to rise, further propelling the market forward.

Technological Advancements in UAV Sensors

The Global Military UAV Sensor Industry benefits significantly from rapid technological advancements. Innovations in sensor technology, such as improved imaging capabilities and enhanced data processing, are transforming the operational effectiveness of UAVs. For example, the integration of artificial intelligence and machine learning into UAV sensors allows for real-time data analysis and decision-making. This evolution not only enhances situational awareness but also increases the efficiency of military operations. As these technologies continue to develop, they are likely to drive the demand for advanced UAV sensors, contributing to the market's projected growth.

Geopolitical Tensions and Security Threats

The Global Military UAV Sensor Industry is significantly impacted by rising geopolitical tensions and security threats. Nations are compelled to enhance their defense capabilities in response to evolving threats, leading to increased investments in military technologies, including UAV sensors. For instance, ongoing conflicts and territorial disputes have prompted countries to prioritize the development and deployment of UAVs for intelligence gathering and surveillance. This heightened focus on national security is likely to sustain the demand for advanced UAV sensors, thereby driving market growth in the coming years.

Integration of UAVs in Military Operations

The Global Military UAV Sensor Industry is witnessing a trend towards the integration of UAVs into various military operations. As armed forces recognize the strategic advantages of UAVs, there is a growing emphasis on incorporating these platforms into conventional military strategies. This integration enhances operational capabilities, allowing for more effective mission planning and execution. The increasing reliance on UAVs for diverse applications, from reconnaissance to combat support, is expected to fuel the demand for advanced UAV sensors. Consequently, this trend is likely to contribute to the market's growth trajectory, with projections indicating a rise to 3.99 USD Billion by 2035.

Rising Demand for Surveillance and Reconnaissance

The Global Military UAV Sensor Industry is largely influenced by the increasing demand for surveillance and reconnaissance capabilities. Military organizations are increasingly utilizing UAVs equipped with advanced sensors to gather intelligence and monitor activities in real-time. This trend is particularly evident in conflict zones where traditional surveillance methods may be limited. The ability of UAV sensors to provide high-resolution imagery and data analytics enhances operational effectiveness. As global security concerns escalate, the demand for UAV sensors is expected to grow, supporting the market's expansion and contributing to the anticipated CAGR of 6.34% from 2025 to 2035.