Growing Geopolitical Tensions

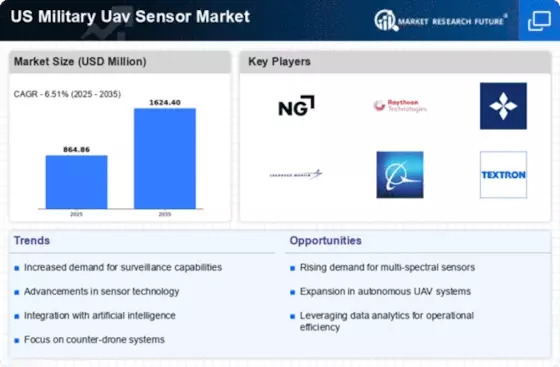

The US Military UAV Sensor Market is experiencing growth due to escalating geopolitical tensions globally. As nations enhance their military capabilities, the demand for advanced surveillance and reconnaissance systems has surged. The US Department of Defense has recognized the necessity for superior intelligence, surveillance, and reconnaissance (ISR) capabilities, leading to increased investments in UAV sensor technologies. In fiscal year 2025, the budget allocated for UAV systems reached approximately $10 billion, reflecting a commitment to bolster national security. This trend suggests that the US Military UAV Sensor Market will continue to expand as military operations increasingly rely on UAVs equipped with sophisticated sensors to gather real-time intelligence and maintain situational awareness.

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into UAV sensor systems is transforming the US Military UAV Sensor Market. These technologies enhance data analysis capabilities, enabling UAVs to process vast amounts of information in real-time. AI algorithms can identify patterns and anomalies, improving decision-making processes for military operations. The US military has initiated several projects to incorporate AI into UAV systems, with an estimated investment of $500 million in 2025. This integration not only increases the operational effectiveness of UAVs but also reduces the cognitive load on operators, suggesting a promising future for the US Military UAV Sensor Market as these technologies become more prevalent.

Regulatory Support and Funding Initiatives

Regulatory support and funding initiatives play a crucial role in shaping the US Military UAV Sensor Market. The US government has established various programs to promote the development and deployment of UAV technologies, including sensors. The National Defense Authorization Act (NDAA) has allocated substantial funding for UAV sensor research and development, with a projected budget of $2 billion for 2025. Additionally, regulatory frameworks are evolving to facilitate the integration of UAVs into national airspace, which is essential for expanding their operational capabilities. This supportive environment indicates a favorable outlook for the US Military UAV Sensor Market, as increased funding and regulatory clarity are likely to drive innovation and adoption of advanced sensor technologies.

Technological Innovations in Sensor Systems

Technological advancements are a primary driver of the US Military UAV Sensor Market. Innovations in sensor technology, such as miniaturization, enhanced imaging capabilities, and improved data processing, have significantly increased the effectiveness of UAVs. For instance, the integration of synthetic aperture radar (SAR) and electro-optical/infrared (EO/IR) sensors has enabled UAVs to operate in diverse environments and conditions. The US military has invested heavily in research and development, with an estimated $1.5 billion allocated for sensor technology enhancements in 2025. These innovations not only improve operational efficiency but also expand the range of missions that UAVs can undertake, thereby driving growth in the US Military UAV Sensor Market.

Increased Focus on Counterterrorism Operations

The US Military UAV Sensor Market is significantly influenced by the heightened focus on counterterrorism operations. The need for precise and timely intelligence has led to an increased deployment of UAVs equipped with advanced sensors in conflict zones. The US military has utilized UAVs extensively in operations against terrorist organizations, emphasizing the importance of real-time surveillance and target acquisition. In 2025, it is projected that over 60% of UAV missions will be dedicated to counterterrorism efforts, underscoring the reliance on sophisticated sensor technologies. This trend indicates a sustained demand for UAV sensors that can provide actionable intelligence, thereby propelling the growth of the US Military UAV Sensor Market.