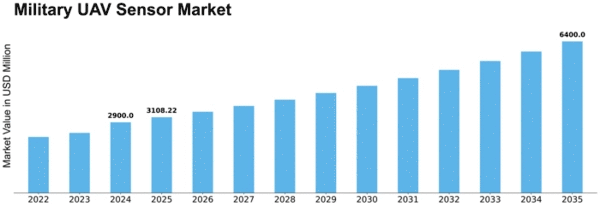

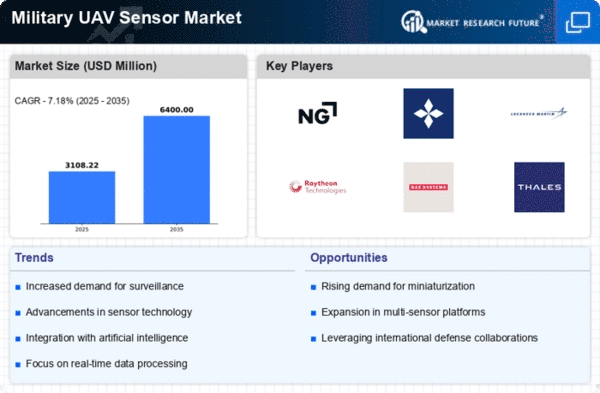

Military Uav Sensor Size

Military UAV Sensor Market Growth Projections and Opportunities

The development, advancement, and cutthroat climate of the military UAV sensor market are essentially influenced by various basic factors that work inside the safeguard area. Mechanical progressions are the transcendent impetuses in this market. The development of UAV sensors is pushed by continuous headways in sensor innovation, including the formation of hyperspectral imaging frameworks, EO/IR cameras with higher goals, radar frameworks, and refined signal handling capacities. These improvements assume a urgent part in tending to the changing prerequisites of protection applications, impelling the advancement and execution of further developed and effective sensor frameworks for UAVs in the military. Besides, the rising spotlight on further developing observation and reconnaissance functionalities is a significant impetus for the requirement for military UAV sensors. The sensors being referred to are critical as they outfit military powers with situational mindfulness, target securing abilities, and continuous insight. Market factors are affected by the necessity for automated UAVs to gather crucial information, supervise activities, and distinguish potential dangers across different scenes and conditions. Accordingly, ventures and improvements in sensor advances are coordinated towards fulfilling the developing needs of safeguard applications. Besides, the military UAV sensor area is significantly impacted by market factors that are impelled by advancing security dangers and the unique idea of contentions. Modern observation and recognition capacities are important to counter offside dangers, hilter kilter fighting, and counterinsurgency tries. The use of military UAV sensors is urgent to upgrade knowledge, recognize, and identify expected dangers. Subsequently, market factors are affected by the expanded interest for sensors that can work effectively in troublesome and complex conditions. Further, market elements in the military UAV sensor industry are considerably affected by administrative guidelines and consistency commitments. Sensors intended for UAVs planned for military utilize should adjust to thorough quality, wellbeing, and functional standards to ensure reliability, accuracy, and adherence to safeguard guidelines. To guarantee that their sensors fit the bill for safeguard contracts, producers distribute assets towards fulfilling these thorough guidelines, accordingly, applying an effect on acquisition choices and market elements through the requirement of such principles. Cost contemplations fundamentally impact market elements in the military UAV sensor industry. While seeking after practical arrangements, protection organizations attempt to keep up with execution and quality principles. Upper hand is obtained by producers who offer seriously estimated superior execution sensors; this benefit is appeared as market impact, as it draws in guard organizations that are looking for esteem situated arrangements. Further, tries committed to innovative work (Research and development) cultivate seriousness and advancement on the lookout for military UAV sensors. Organizations keep an upper hand by putting resources into Research and development drives that upgrade sensor innovations, capacities, capacities coordination, and cost decrease, as well as the combination of refined highlights. Market factors are significantly impacted by ceaseless improvements in sensor scaling down, upgraded usefulness, information handling, and reconciliation, which move the development of UAV sensor frameworks that are more adaptable and proficient. Mechanical progressions, the interest for further developed observation abilities, changing guard prerequisites, administrative consistence, cost-viability, and ceaseless advancement all impact market factors in the military UAV sensor area. In a time where safeguard prerequisites proceed to change and focus on precision, adaptability, and upgraded observation functionalities, the progression and execution of UAV sensor innovation will endure as urgent determinants of market elements and project workers' future military UAV sensor arrangements.

Leave a Comment