Research Methodology on Military Radio System Market

1. Introduction

The research report on the Military Radio System (MRS) market provides a detailed analysis of the various components that are expected to govern the growth of the sector. The research report is based on extensive primary and secondary research that includes qualitative and quantitative research analysis. The research approach was developed to provide an accurate view of the market dynamics, such as the opportunities and challenges encountered by industry participants, current trends, and expected market size in terms of revenue and volume over the forecast period. In order to arrive at these conclusions, it uses a combination of various sources of information, such as government reports and market participant newsletters, in addition to its own primary and secondary market insights.

2. Research Method

The research type for this project comprises primary and secondary research. The project was undertaken to understand the factors influencing the growth of the military radio systems market. It focused on the current trends and growth opportunities faced by market participants. A comprehensive market analysis was performed with the help of qualitative and quantitative research techniques.

2.1 Primary Research

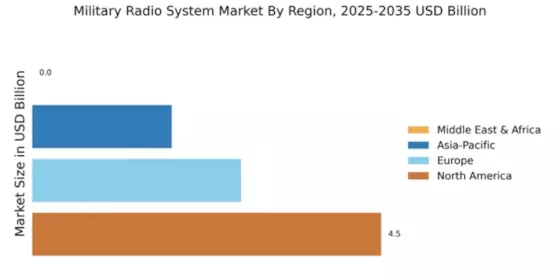

The primary research involves gathering data from industry leaders, military organizations, and key participants in order to get an in-depth understanding of the various components that are expected to affect the market. It includes interviews and surveys with key executives and market experts. In addition, the research was carried out in various geographies, such as Asia-Pacific, North America, Europe, and other regions.

2.2 Secondary Research

The secondary research included searching and analyzing relevant information from various published archives and databases, such as market research reports, annual reports, press releases, industry journals, trade magazines, and news articles. Additionally, the secondary research involved taking into account the opinions of industry experts and market stakeholders.

3. Market Dynamics

The research report provides an analysis of the varied components that are likely to drive the growth of the MRS market. The key market dynamics such as the drivers, trends, and challenges are highlighted in this report. The research takes into account the macroeconomic factors that are crucial for the development of the military radio systems market.

3.1 Drivers

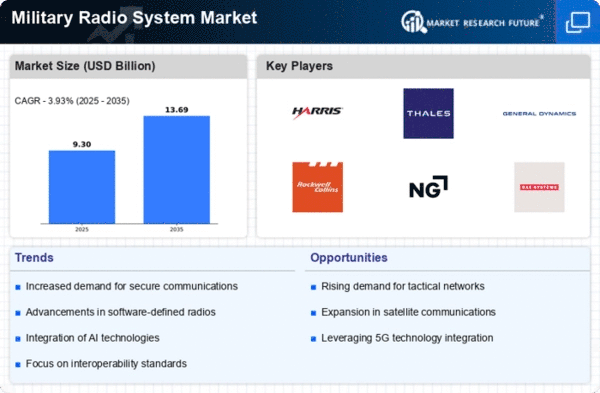

The rising adoption of technology in military applications, such as surveillance and reconnaissance, is driving the demand for MRS systems. The increasing use of radio systems for border security and data communication is further augmenting the growth of the market. Furthermore, advancements in radio systems technology are expected to create growth opportunities for the market.

3.2 Trends

The rising demand for a wide range of radios to cater to different requirements, such as high frequency and satellite communication, is driving innovations in MRS technology. The advancements in networking technologies are creating growth opportunities in the military radio systems market.

3.3 Challenges

High capital costs are expected to be the major challenge hindering the growth of the market. In addition, the lack of skilled personnel to operate the radio systems could restrain the growth of the market.

4. Market Segmentation

The research report provides a segmentation of the global MRS market based on component, frequency band, platform, technology, and region. The component segmentation includes analogue and digital. In terms of frequency bands, the research segmented the market into low frequency, medium frequency, high frequency, ultra-high frequency, and others.

The platform segment is divided into land, marine, and aerial. The technology segment for the military radio systems market is divided into software-defined radios, wireless Wi-Fi, and others. The study takes into account various regions such as North America, Europe, Asia-Pacific, the Middle East and Africa, and other regions.

5. Analysis Methodology

For the research study, a top-down and bottom-up approach was used to estimate the market size. The numbers obtained in this stage were validated by involving primary research sources. The key players in the MRS market were identified through extensive secondary and primary research activities. The major players were also identified and their respective shares in the market were validated with the help of primary research reviews.

To estimate the market size and analyze the data, Porter's Five Forces model was used. The detailed market segments and sub-segments, geographical analysis, and competitive landscape were taken into consideration while estimating the market size.

6. Market Estimation and Forecasting

The market estimation process ascertained the value of the MRS market by analyzing the past and present market dynamics. The market forecast was done by adopting a bottom-up and top-down approach. To arrive at the market size and forecast, the regional-wise historical market data was analyzed. The regional analysis was also done with the help of economic parameters such as market size, growth rate, and production capacity.

7. Conclusion

The report provides a comprehensive overview of the military radio systems market, covering the various components that are expected to propel the growth of the market. A detailed analysis of the various growth dynamics was undertaken in order to provide a complete understanding of the potential opportunities and challenges. The detailed market segmentation and regional analysis, combined with the insights obtained through primary and secondary research, were used to derive the market estimates and forecasts for 2023 to 2030.