Market Trends

Key Emerging Trends in the Military Radio System Market

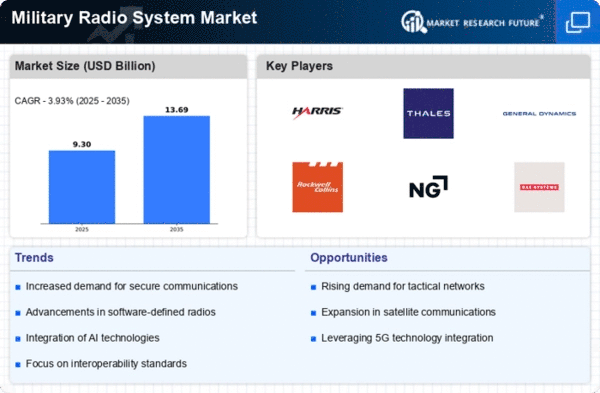

The Military Radio System market is undergoing significant transformations tied to advancements in communication technologies, evolving security threats, and modernization of armed forces worldwide. One such trend that has emerged in this sector lately is a switch towards Software Defined Radios (SDRs). The use of SDR technology in military radio systems has been increasing as it offers more flexibility as well as interoperability. SDRs make it possible to reconfigure radio frequencies or waveforms thereby enabling seamless communications among various platforms while they must adapt to dynamic complex operational environments.

The vehicular radio segment will see substantial growth among several categories within the period under consideration. These vehicle-mounted devices which go by the name mobile two-way radios are essential for establishing secure as well as reliable communication links within local regions, urban areas or even battlefields.

There has been an increased demand for secure and resilient communication solutions within the market. At present when looking at best practices about developing & deploying radios used by their personnel who need robust encryption; anti-jamming capabilities; and secure communications protocols; militaries are shifting all their priorities into ensuring that these things occur . This takes into account issues relating to electronic warfare which includes ensuring confidentiality & integrity of military comms since this is a reflection of the ongoing efforts to outsmart potential enemies.

The use of AI and machine learning capabilities in Military Radio System market is another trend that should be noted. Through AI, advanced radio systems can autonomously adapt to new environments; optimize frequency allocation and thus enhance overall communications efficiency. These smart radio systems speed up the decision-making processes in addition to improving battlefield situational awareness.

In Military Radio Systems, market trends have been influenced by miniaturization and portability considerations. The military needs light and small radios with no compromise on performance. On the other hand, developments in lightweight and compact man-portable as well as vehicle mounted radios reduce the size and weight for easier mobility of forces while increasing overall agility of military operations.

Adoption of next-generation waveforms has driven innovation within the Military Radio System market. Modern military operations require high-speed & reliable communication, hence advanced waveforms such as Wideband Networking Waveform (WNW) or Soldier Radio Waveform (SRW) have emerged due to increased need for effective data transfers with multimedia support. Such waveforms are aimed at meeting the demands for fast data transmission rates so as to facilitate efficient communication throughout present military scenarios.

There is an increasing emphasis on cybersecurity when it comes to developing Military Radio Systems. Given this greater complexity surrounding cyber threats, modern-day military radio systems incorporate robust cybersecurity features capable of preventing unauthorized access as well as hacking among others vulnerabilities. In fact, this trend acknowledges that contemporary communication systems are intertwined with one another hence sensitive information related to militaries must be protected from attacks.

Leave a Comment