Focus on Energy Security

Energy security remains a critical concern for military operations, thereby impacting the military generator Market. As military forces operate in diverse environments, the need for secure and reliable power sources becomes paramount. The increasing frequency of military deployments in remote areas necessitates portable and efficient generators that can ensure uninterrupted power supply. This focus on energy security is driving innovations in generator technology, such as the development of renewable energy solutions and energy storage systems. The market is likely to witness a shift towards generators that not only provide power but also enhance energy resilience, reflecting the evolving needs of modern military operations within the Military Generator Market.

Increased Defense Budgets

The Military Generator Market is significantly influenced by the rising defense budgets across various nations. Governments are allocating more resources to enhance their military capabilities, which includes upgrading power generation systems. In recent years, defense spending has seen an upward trend, with many countries increasing their budgets by an average of 3-5% annually. This financial commitment is likely to drive investments in advanced military generators, as armed forces require reliable and efficient power sources for operations. The emphasis on modernization and readiness is expected to further propel the demand for military generators, indicating a robust growth trajectory for the Military Generator Market in the coming years.

Growing Demand for Portable Generators

The Military Generator Market is witnessing a growing demand for portable generators, which are essential for various military applications. These generators offer flexibility and mobility, allowing military units to deploy power sources quickly in the field. The increasing emphasis on rapid response capabilities in military operations is likely to drive the demand for lightweight and compact generator systems. Furthermore, advancements in technology are enabling the production of portable generators that are more fuel-efficient and environmentally friendly. As military operations become more dynamic, the need for versatile power solutions is expected to rise, thereby contributing to the expansion of the Military Generator Market.

Technological Advancements in Military Generators

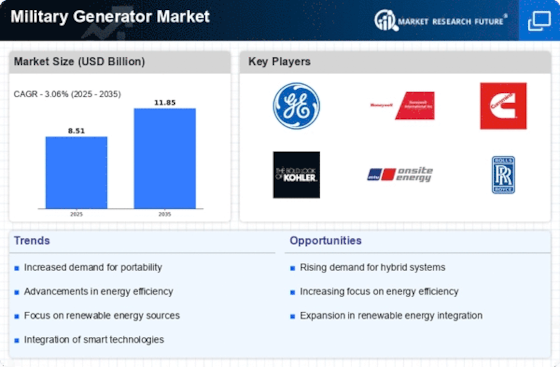

The Military Generator Market is experiencing a notable transformation due to rapid technological advancements. Innovations in generator design, such as the integration of hybrid systems and improved fuel efficiency, are enhancing operational capabilities. For instance, the introduction of advanced materials and smart technologies is enabling generators to operate in extreme conditions, which is crucial for military applications. Furthermore, the market is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years, driven by these technological improvements. As militaries seek to modernize their equipment, the demand for state-of-the-art generators that offer reliability and efficiency is likely to increase, thereby shaping the future landscape of the Military Generator Market.

Environmental Regulations and Sustainability Initiatives

The Military Generator Market is increasingly shaped by environmental regulations and sustainability initiatives. Governments and military organizations are under pressure to reduce their carbon footprint and comply with stringent environmental standards. This has led to a growing interest in generators that utilize cleaner fuels and incorporate sustainable practices. The market is likely to see a rise in the adoption of generators that are designed to minimize emissions and enhance energy efficiency. As militaries strive to align their operations with global sustainability goals, the demand for eco-friendly military generators is expected to increase, indicating a shift in the market dynamics of the Military Generator Market.