Increasing Energy Demand

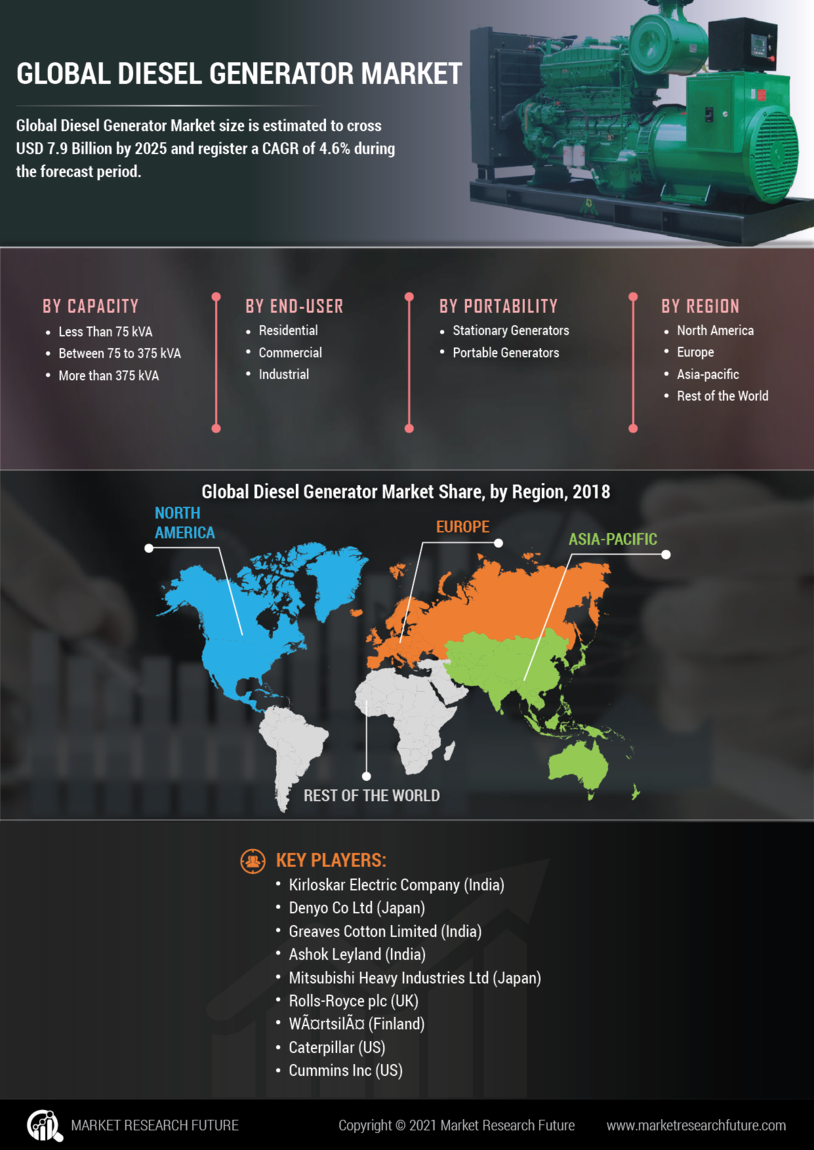

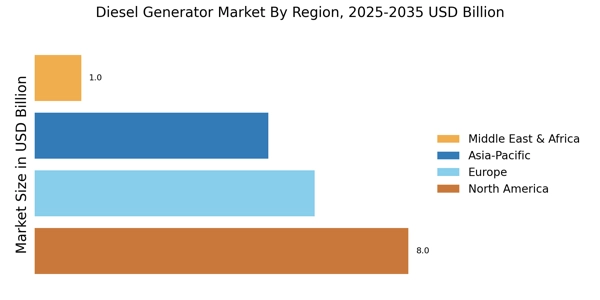

The Diesel Generator Market is experiencing a surge in demand for energy across various sectors. This increase is driven by urbanization, industrialization, and the growing population, which collectively contribute to higher energy consumption. According to recent data, energy demand is projected to rise by approximately 30% by 2030. Consequently, diesel generators are becoming essential for providing reliable power, especially in regions with unstable electricity supply. The need for backup power solutions in commercial and residential sectors further propels the market. As industries expand and new infrastructures are developed, the Diesel Generator Market is likely to witness sustained growth, driven by the necessity for dependable energy sources.

Technological Innovations

Technological innovations are transforming the Diesel Generator Market, leading to the development of more efficient and environmentally friendly generators. Advances in engine technology, fuel efficiency, and emissions control are making diesel generators more appealing to consumers. The introduction of smart technology, such as remote monitoring and automated controls, enhances operational efficiency and reduces downtime. Market data indicates that the adoption of these innovations could lead to a 15% increase in market share for advanced diesel generators by 2027. As industries seek to reduce their carbon footprint while maintaining power reliability, the Diesel Generator Market is likely to evolve, driven by these technological advancements.

Infrastructure Development

Infrastructure development plays a pivotal role in the expansion of the Diesel Generator Market. Governments and private entities are investing heavily in building roads, bridges, and other essential facilities, particularly in developing regions. This investment is expected to create a substantial demand for diesel generators, which are often utilized in construction sites and temporary facilities. The construction sector's reliance on diesel generators for uninterrupted power supply during projects indicates a robust market potential. Furthermore, as infrastructure projects are anticipated to increase by 25% over the next five years, the Diesel Generator Market is poised for significant growth, driven by the need for reliable power solutions.

Reliability and Efficiency

The Diesel Generator Market is characterized by the reliability and efficiency of diesel generators, which are preferred for their ability to provide consistent power. Diesel generators are known for their durability and lower operational costs compared to other power generation sources. This efficiency is particularly appealing to industries that require continuous power supply, such as manufacturing and healthcare. The market data suggests that diesel generators can operate for longer periods without the need for frequent maintenance, making them a cost-effective solution. As businesses increasingly prioritize operational efficiency, the Diesel Generator Market is likely to benefit from the growing preference for reliable power sources.

Regulatory Support for Energy Security

Regulatory frameworks aimed at enhancing energy security are influencing the Diesel Generator Market positively. Governments are implementing policies that encourage the use of diesel generators as a backup power source, particularly in critical sectors such as healthcare and telecommunications. These regulations often mandate that businesses maintain a certain level of backup power to ensure operational continuity. As a result, the demand for diesel generators is expected to rise, with market analysts projecting a growth rate of around 5% annually over the next decade. This regulatory support not only bolsters the Diesel Generator Market but also emphasizes the importance of energy resilience in various sectors.