North America : Defense Innovation Leader

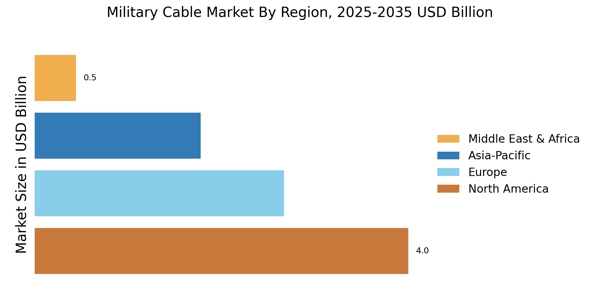

North America is the largest market for military cables, holding approximately 45% of the global share. The region's growth is driven by increasing defense budgets, technological advancements, and a focus on modernization of military infrastructure. Regulatory support from government initiatives further catalyzes demand, ensuring compliance with stringent military standards. The U.S. Department of Defense's investments in advanced communication systems are pivotal in shaping market dynamics.

The United States dominates the North American military cable market, with key players like General Cable, Southwire Company, and TE Connectivity leading the charge. The competitive landscape is characterized by innovation and strategic partnerships, as companies strive to meet the evolving needs of military applications. The presence of established manufacturers ensures a robust supply chain, enhancing the region's market position.

Europe : Emerging Defense Market

Europe is witnessing significant growth in the military cable market, accounting for approximately 30% of the global share. The region's demand is fueled by increasing defense expenditures, geopolitical tensions, and a commitment to enhancing military capabilities. Regulatory frameworks, such as the European Defense Fund, are instrumental in promoting collaborative defense projects, thereby boosting market growth. Countries are investing in advanced technologies to ensure operational readiness and interoperability.

Leading countries in Europe include Germany, France, and the United Kingdom, which are home to major players like Prysmian Group and Nexans. The competitive landscape is marked by innovation and a focus on sustainability, with companies developing eco-friendly cable solutions. The presence of established manufacturers and a growing number of startups contribute to a dynamic market environment, fostering competition and technological advancements.

Asia-Pacific : Rapidly Expanding Market

Asia-Pacific is emerging as a significant player in the military cable market, holding around 20% of the global share. The region's growth is driven by increasing military budgets, modernization efforts, and rising geopolitical tensions. Countries like India and China are ramping up their defense capabilities, leading to a surge in demand for advanced military cables. Regulatory initiatives aimed at enhancing defense infrastructure further support market expansion.

Key players in the Asia-Pacific region include Amphenol Corporation and Lapp Group, which are focusing on innovation and technology to meet the growing demands of military applications. The competitive landscape is characterized by a mix of established companies and new entrants, fostering a dynamic environment. As nations invest in advanced military technologies, the demand for high-performance cables is expected to rise significantly, shaping the future of the market.

Middle East and Africa : Strategic Defense Investments

The Middle East and Africa region is witnessing a gradual increase in the military cable market, accounting for approximately 5% of the global share. The growth is primarily driven by rising defense budgets, regional conflicts, and a focus on enhancing military capabilities. Governments are investing in modernizing their armed forces, which includes upgrading communication and operational systems. Regulatory support for defense initiatives is also contributing to market growth in this region.

Leading countries in this region include the United Arab Emirates and South Africa, where key players are beginning to establish a foothold. The competitive landscape is evolving, with both local and international companies vying for market share. As defense spending continues to rise, the demand for reliable and advanced military cables is expected to increase, providing opportunities for growth in the coming years.