Research Methodology on Fibre Optic Cable Market

Introduction

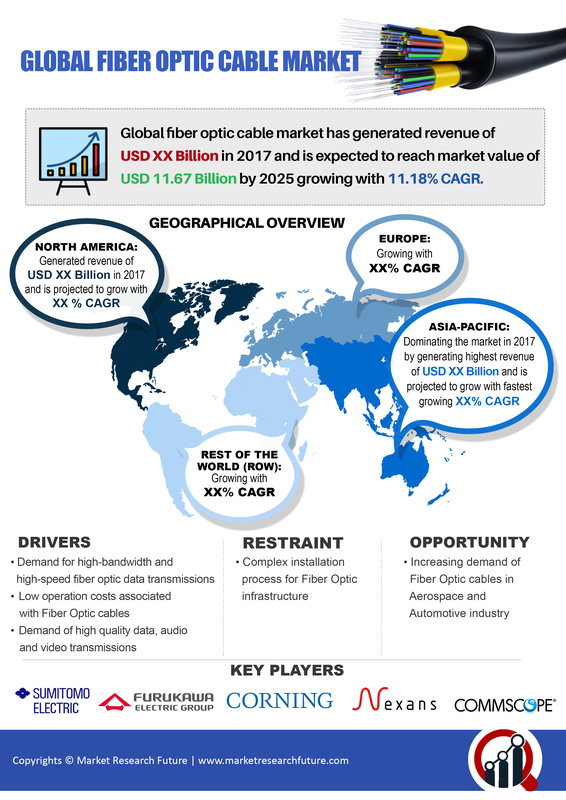

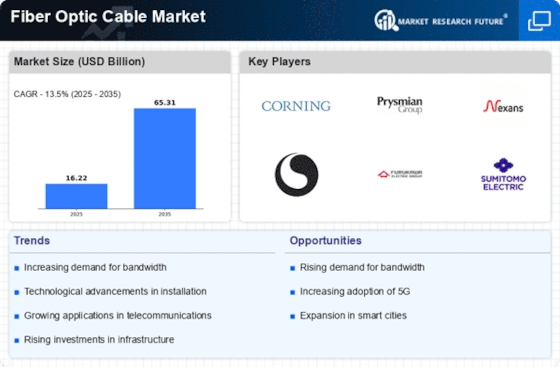

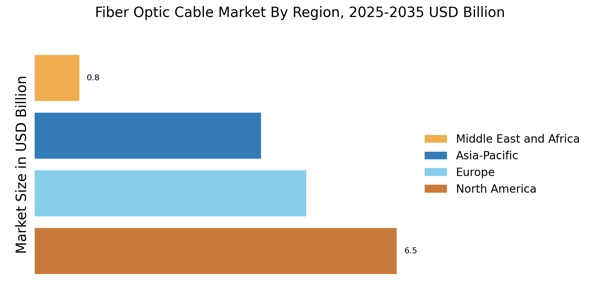

The fibre optic cable market has experienced a steady rise over the past decade, driven by the growing demand for superior mobile network coverage, and the wide usage of optical fibre in data delivery systems across various industries. As this technology becomes more commonplace, the demand for fibre optic cables in different geographies continues to grow. The objective of this research is to analyse the current and future trends of the fibre optic cable market, its various key drivers, restraining factors, and related opportunities, and to create a comprehensive report of the same.

Research Methodology:

This research project is conducted using a combination of secondary and primary research data. The secondary research data sources include published reports and papers related to the fibre optic cable market. Such papers are expected to provide details about the regional market developments in technology, current trends, and future market forecasts. Furthermore, informed opinions from industry professionals and subject matter experts are obtained through interviews, which can be conducted through teleconference, in-person meetings, or online.

Research Questions:

The following research questions guide the framing of this research:

- What are the current and forecasted trends in the global fibre optic cable market?

- What are the major drivers and restraints in the global fibre optic cable market?

- What new opportunities are emerging for fibre optic cables in various geographies?

- What are the key strategies adopted by major players in the fibre optic cable market?

Data Collection:

The secondary data sources for this research include industry reports and studies, custom databases, government sources, and academic journals. Such sources provide reliable information about market size and estimates, detailed competitive analysis, and macro and micro-market trends. The primary data sources for this research include interviews with various industry experts and professionals, as well as focus groups and surveys. Through such information, the research team will be able to identify key drivers and restraints in the fibre optic cable market, and current and emerging opportunities, and gain insights into strategies adopted by major players.

Data Analysis:

Quantitative data gathered is analysed using descriptive statistical tools, such as student's t-test and ANOVA, to analyse the test results and draw meaningful conclusions. Furthermore, market studies are conducted to refine the secondary data into market segments and region-specific sub-segments, which are further analysed using charting and plotting tools for better. Moreover, SPSS and SAS are used for further data mining, which helps the research team analyse the market in detail.

Ethical Considerations:

The research team follows a rigorous ethical process throughout the duration of their project. All questions used in primary data collection tools such as surveys and focus groups are pre-approved to ensure no breach of ethics takes place. Furthermore, all respondents are informed about the purpose of the research, and more importantly, about their right to withdraw from the research process, and the research team does not make use of any deception in their research.

Conclusion:

This research project intends to provide insights into the fibre optic cable market and its various trends, drivers and restraining factors, and future prospects. By using a combination of primary and secondary data sources, the research team intends to provide a comprehensive analysis of the market, while taking all ethical considerations into account.