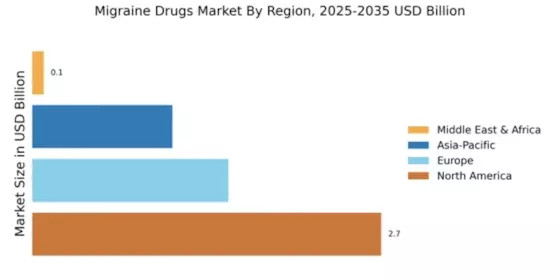

North America : Market Leader in Innovation

North America continues to lead the migraine drugs market, holding a significant share of 2.74 billion in 2024. The region's growth is driven by increasing awareness of migraine disorders, advancements in drug formulations, and supportive healthcare policies. Regulatory bodies are actively promoting innovative treatments, which further fuels market demand. The rising prevalence of migraines among the population is also a key factor contributing to this growth.

The competitive landscape in North America is robust, featuring major players like Amgen, Eli Lilly, and AbbVie. These companies are investing heavily in research and development to introduce new therapies. The U.S. market, in particular, is characterized by a high adoption rate of novel migraine treatments, including CGRP inhibitors. This competitive environment is expected to enhance treatment options and improve patient outcomes, solidifying North America's position as a market leader.

Europe : Emerging Market with Growth Potential

Europe's migraine drugs market is valued at 1.54 billion, reflecting a growing demand for effective treatments. The region benefits from a well-established healthcare system and increasing investments in healthcare infrastructure. Regulatory frameworks are evolving to facilitate faster approvals for innovative migraine therapies, which is expected to drive market growth. Additionally, the rising incidence of migraines in Europe is prompting healthcare providers to seek more effective solutions for patients.

Leading countries in this region include Germany, France, and the UK, where key players like Boehringer Ingelheim and Novartis are actively engaged. The competitive landscape is marked by collaborations between pharmaceutical companies and healthcare providers to enhance treatment accessibility. As the market evolves, the focus on personalized medicine and patient-centric approaches is likely to shape the future of migraine treatment in Europe.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific migraine drugs market is valued at 1.1 billion, showcasing significant growth potential. Factors such as rising healthcare expenditure, increasing awareness of migraine disorders, and a growing population are driving demand for effective treatments. Regulatory bodies in the region are also working to streamline approval processes for new drugs, which is expected to enhance market accessibility. The increasing prevalence of migraines in urban areas is further fueling this demand.

Countries like Japan, China, and India are leading the market, with key players such as Teva Pharmaceutical and Pfizer making substantial investments. The competitive landscape is characterized by a mix of local and international companies striving to capture market share. As the region continues to develop, the focus on innovative therapies and improved patient access will be crucial for sustained growth in the migraine drugs market.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa migraine drugs market is valued at 0.09 billion, indicating significant challenges in access to effective treatments. Factors such as limited healthcare infrastructure, economic constraints, and varying levels of awareness about migraine disorders contribute to this market's slow growth. However, there is a growing recognition of the need for better migraine management, which may drive future demand. Regulatory bodies are beginning to address these challenges by promoting awareness and improving healthcare access.

Countries like South Africa and the UAE are at the forefront of market development, with local and international players exploring opportunities. The competitive landscape is still developing, with a focus on increasing availability of existing treatments. As awareness and healthcare access improve, the market is expected to gradually expand, offering new opportunities for growth in the coming years.