Advancements in Drug Development

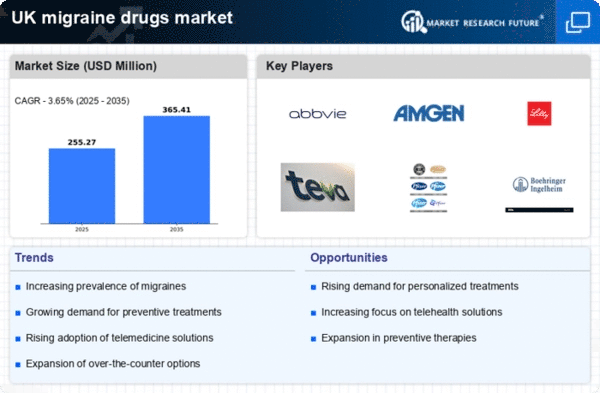

Innovations in drug development are significantly impacting the migraine drugs market. The introduction of novel therapeutic agents, such as CGRP inhibitors, has transformed treatment paradigms, offering patients more effective options. These advancements are not only improving patient outcomes but also driving market growth. In the UK, the approval of new migraine medications has been met with enthusiasm, as they provide alternatives to traditional treatments. The market is projected to witness a compound annual growth rate (CAGR) of around 7% over the next few years, driven by these advancements. Furthermore, ongoing clinical trials and research initiatives are likely to yield additional therapies, enhancing the overall landscape of the migraine drugs market.

Increased Awareness and Education

There is a growing awareness and education surrounding migraine disorders, which is positively influencing the migraine drugs market. Healthcare professionals and patients are becoming more informed about the various treatment options available, leading to better management of migraine conditions. Campaigns aimed at educating the public about migraine symptoms and treatment options have gained traction in the UK, resulting in increased consultations and prescriptions. This heightened awareness is expected to contribute to a rise in the utilization of migraine medications, thereby expanding the market. As patients become more proactive in seeking treatment, the demand for effective migraine drugs is likely to increase, further driving market growth.

Economic Factors and Market Dynamics

Economic factors are significantly influencing the migraine drugs market in the UK. The rising costs of healthcare and medications are prompting patients and healthcare providers to seek cost-effective treatment options. This economic pressure may lead to increased demand for generic migraine medications, which are often more affordable than branded counterparts. Furthermore, the overall economic climate can impact healthcare spending, influencing the availability of funds for migraine treatments. As patients navigate these economic challenges, the market may see a shift towards more budget-friendly solutions. This dynamic is likely to shape the competitive landscape of the migraine drugs market, as companies adapt their strategies to meet the evolving needs of consumers.

Rising Prevalence of Migraine Disorders

The increasing prevalence of migraine disorders in the UK is a primary driver for the migraine drugs market. Recent estimates suggest that approximately 15% of the UK population suffers from migraines, leading to a growing demand for effective treatment options. This rising incidence is likely to be influenced by various factors, including lifestyle changes and environmental triggers. As more individuals seek relief from debilitating migraine symptoms, the market for migraine drugs is expected to expand. The economic burden associated with migraines includes lost productivity and healthcare costs. This further emphasizes the need for innovative therapies. Consequently, pharmaceutical companies are investing in research and development to address this unmet medical need, thereby propelling the migraine drugs market forward.

Healthcare System Support and Accessibility

The support of the UK healthcare system plays a crucial role in shaping the migraine drugs market. The National Health Service (NHS) provides access to a range of migraine treatments, ensuring that patients can obtain necessary medications. This accessibility is vital for individuals suffering from chronic migraines, as it facilitates timely intervention and management. Additionally, the NHS's commitment to funding innovative therapies enhances the market landscape, as new drugs are made available to patients. The integration of migraine management into primary care services is also likely to improve patient outcomes, thereby fostering growth in the migraine drugs market. As healthcare policies evolve, the emphasis on effective migraine treatment is expected to remain a priority.