Market Trends

Key Emerging Trends in the Migraine Drugs Market

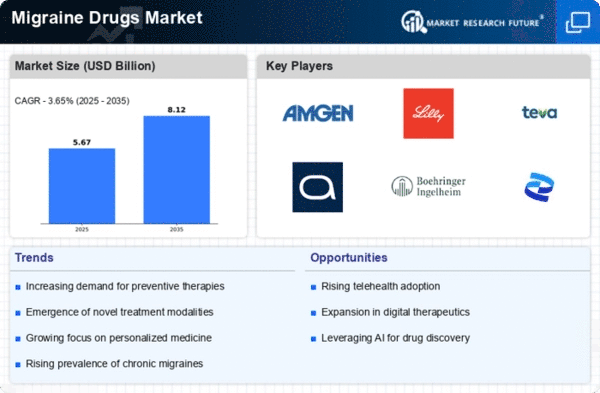

Around the world, more and more people are getting headaches, which is making drugs for them more and more important. Every day, more and more people learn about headaches. This has made the drug industry look for helpful treatments like crazy. New migraine medicines are now possible because of recent progress in the study of drugs. As new ingredients and ways to move them come out, migraine drugs get better and easier to use. A lot of money is being spent by drug companies on research and development (R&D) to make better migraine meds that are just right for each person. This extra help has sped up the search for possible new medicines, and there are now a lot of good choices. More and more people who get headaches are taking pills because they are easy to use and don't hurt as much. Drug companies have been working hard to make better oral versions to keep up with the growing demand. Though it's growing in both rich and poor countries, the migraine medicine business is likely to spread around the world. The market growth trend is being driven by more and more evidence that headaches make people's daily lives worse. There are more and more genetic drugs being used to treat headaches because they can be tailored to each person and may have fewer side effects. Biotechs are getting a lot of attention right now, which is part of a bigger trend in the business toward precision care. It's possible that more people are getting headaches and having better care for them because more people know about them and can get it. Since this was found, the migraine medicine business as a whole is getting stronger. As more and more agreements are made, drug businesses and schools work together. Sharing information with each other can help everyone. It will save time and effort, and it will bring in more money for research into migraine drugs. Now that there are more new migraine treatments on the market, it is easier to get them because regulatory groups support drug research and licensing. Companies that treat headaches are more likely to spend money on research and development since rules aren't too strict. In the past few years, personalized medicine, which means making unique care plans for each patient, has grown in popularity. One goal of this method is to help migraine sufferers get better treatment. This is part of a bigger trend in healthcare toward precision medicine.

Leave a Comment