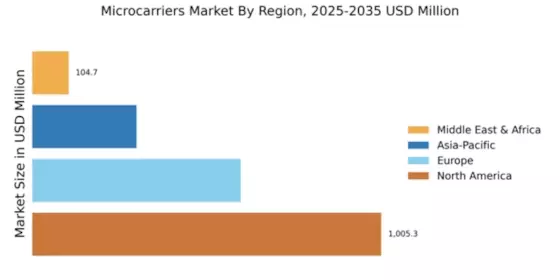

Market Growth Projections

The Global Microcarriers Market Industry is poised for substantial growth, with projections indicating a market value of 0.92 USD Billion in 2024, potentially reaching 1.82 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 6.42% from 2025 to 2035. The increasing adoption of microcarriers in biopharmaceutical manufacturing, coupled with advancements in technology and regulatory support, contributes to this optimistic outlook. As the industry evolves, the demand for innovative solutions in cell culture is likely to drive further expansion in the microcarriers market.

Rising Demand for Biopharmaceuticals

The Global Microcarriers Market Industry experiences a surge in demand for biopharmaceuticals, driven by advancements in cell culture technologies. As the biopharmaceutical sector expands, microcarriers play a pivotal role in enhancing the production of vaccines and therapeutic proteins. In 2024, the market is valued at 0.92 USD Billion, reflecting the increasing reliance on microcarriers for efficient cell growth and product yield. This trend is expected to continue, with projections indicating a market growth to 1.82 USD Billion by 2035, suggesting a robust compound annual growth rate (CAGR) of 6.42% from 2025 to 2035.

Growing Focus on Personalized Medicine

The shift towards personalized medicine significantly impacts the Global Microcarriers Market Industry. As healthcare moves towards tailored therapies, the demand for efficient cell culture systems that can support the production of personalized treatments increases. Microcarriers Market provide a versatile platform for growing diverse cell types, facilitating the development of customized therapies. This trend aligns with the broader movement in healthcare towards individualized treatment plans, which are anticipated to drive the demand for microcarriers. The ability to produce specific cell lines efficiently is likely to enhance the market's growth trajectory in the coming years.

Technological Advancements in Cell Culture

Technological innovations in cell culture techniques significantly influence the Global Microcarriers Market Industry. The introduction of advanced microcarrier materials and surface modifications enhances cell attachment and growth, thereby improving overall productivity. These advancements facilitate the scalability of bioprocesses, making them more efficient and cost-effective. As a result, manufacturers are increasingly adopting these technologies to meet the growing demands of the biopharmaceutical sector. The continuous evolution of microcarrier technology is likely to drive market expansion, as companies seek to optimize their production processes and reduce costs.

Increased Investment in Research and Development

Investment in research and development within the biopharmaceutical sector is a crucial driver for the Global Microcarriers Market Industry. As companies strive to innovate and develop new therapies, the need for efficient cell culture systems becomes paramount. Increased funding for R&D initiatives enables the exploration of novel microcarrier applications, enhancing their utility in various therapeutic areas. This trend is indicative of a broader commitment to advancing biopharmaceutical manufacturing processes, which is expected to bolster market growth in the coming years. The focus on R&D is likely to yield new products and applications, further expanding the microcarriers market.

Regulatory Support for Biopharmaceutical Manufacturing

Regulatory frameworks supporting biopharmaceutical manufacturing play a vital role in shaping the Global Microcarriers Market Industry. Governments worldwide are increasingly recognizing the importance of biopharmaceuticals in healthcare, leading to streamlined approval processes and guidelines that encourage innovation. This regulatory support fosters a conducive environment for the development and commercialization of new therapies, thereby driving demand for microcarriers. As regulatory bodies continue to adapt to the evolving landscape of biopharmaceuticals, the market for microcarriers is expected to benefit from increased production capabilities and enhanced product quality.