Expansion of Delivery Services

The Micro Drone Market is poised for growth due to the expansion of delivery services utilizing drone technology. Companies are increasingly exploring the potential of micro drones for last-mile delivery solutions, particularly in urban areas where traditional delivery methods face challenges. Recent reports suggest that the drone delivery market could reach USD 11 billion by 2027, with micro drones playing a pivotal role in this transformation. Their ability to navigate congested environments and deliver packages quickly makes them an attractive option for businesses. As e-commerce continues to flourish, the Micro Drone Market is likely to see heightened interest from logistics companies seeking to optimize their delivery processes and reduce operational costs.

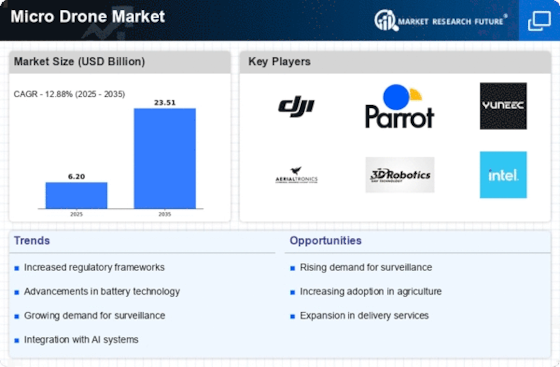

Advancements in Battery Technology

The Micro Drone Market is significantly influenced by advancements in battery technology, which enhance the performance and operational efficiency of micro drones. Innovations in battery design, such as lithium-sulfur and solid-state batteries, are extending flight times and reducing charging durations. This is particularly relevant as the demand for longer operational periods in various applications, including agriculture and surveillance, increases. The market for drone batteries is expected to grow substantially, with projections indicating a value of USD 1.5 billion by 2025. As battery technology continues to evolve, the Micro Drone Market stands to benefit from improved capabilities, enabling drones to perform more complex tasks and operate in diverse environments.

Rising Popularity in Recreational Use

The Micro Drone Market is experiencing a rise in popularity for recreational use, particularly among hobbyists and enthusiasts. The accessibility of micro drones, combined with their affordability and ease of use, has led to a burgeoning community of drone pilots. Recent surveys indicate that the consumer drone market is projected to reach USD 4 billion by 2026, with micro drones constituting a significant portion of this growth. This trend is further supported by the increasing availability of drone racing events and aerial photography competitions, which attract participants from various backgrounds. As recreational use continues to expand, the Micro Drone Market is likely to benefit from a diverse consumer base and increased product offerings.

Growing Demand for Aerial Surveillance

The Micro Drone Market experiences a notable surge in demand for aerial surveillance applications. This demand is driven by the increasing need for security and monitoring in various sectors, including law enforcement, military, and private security. According to recent estimates, the market for aerial surveillance drones is projected to reach USD 2 billion by 2026, indicating a robust growth trajectory. Micro drones, with their compact size and advanced imaging capabilities, are particularly well-suited for surveillance tasks, allowing for discreet monitoring in urban environments. As organizations seek to enhance their surveillance capabilities, the Micro Drone Market is likely to benefit from this trend, leading to innovations in drone technology and increased investment in research and development.

Increased Investment in Infrastructure Inspection

The Micro Drone Market is witnessing increased investment in infrastructure inspection, driven by the need for efficient and cost-effective solutions. Micro drones are being utilized for inspecting bridges, power lines, and pipelines, providing real-time data and reducing the risks associated with manual inspections. The market for drone-based infrastructure inspection is anticipated to grow, with estimates suggesting a value of USD 3 billion by 2028. This growth is fueled by the advantages micro drones offer, such as access to hard-to-reach areas and the ability to gather high-resolution imagery. As industries prioritize safety and maintenance, the Micro Drone Market is likely to see a rise in demand for drones tailored for infrastructure applications.