Government Initiatives

Government initiatives aimed at enhancing public safety are significantly impacting the video surveillance market in Mexico. Various state and local governments are implementing surveillance programs to monitor public spaces and improve law enforcement capabilities. For instance, the installation of surveillance cameras in high-crime areas has been prioritized to deter criminal activities. The video surveillance market is benefiting from these initiatives, as public funding is directed towards upgrading existing systems and deploying new technologies. Reports indicate that government spending on security solutions is expected to increase by 15% annually, further propelling the growth of the video surveillance market. This trend underscores the importance of collaboration between public and private sectors in enhancing security measures.

Rising Security Concerns

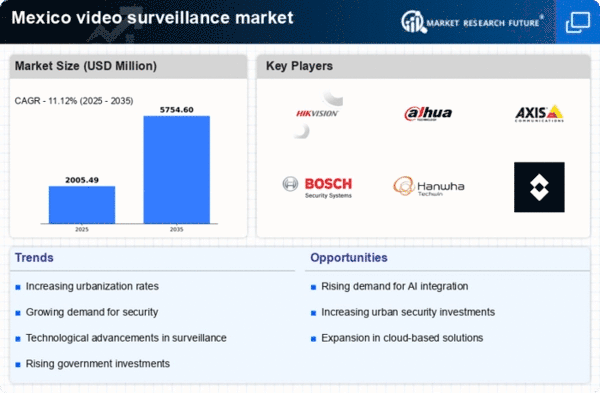

The escalating concerns regarding public safety and security in Mexico are driving the demand for the video surveillance market. With increasing crime rates in urban areas, businesses and government entities are investing in advanced surveillance systems to deter criminal activities. According to recent data, the video surveillance market in Mexico is projected to grow at a CAGR of 12% from 2025 to 2030. This growth is indicative of a broader trend where organizations prioritize security measures to protect assets and ensure the safety of individuals. The video surveillance market is thus witnessing a surge in demand for high-definition cameras, smart analytics, and integrated security solutions that can provide real-time monitoring and response capabilities.

Technological Integration

The integration of advanced technologies such as artificial intelligence (AI) and machine learning into video surveillance systems is transforming the video surveillance market. In Mexico, the adoption of smart surveillance solutions is on the rise, as these technologies enhance the capabilities of traditional systems. AI-driven analytics can identify suspicious behavior and alert security personnel, thereby improving response times. The video surveillance market is experiencing a shift towards cloud-based solutions, which offer scalability and remote access. This technological evolution is expected to attract investments, with the market projected to reach $1 billion by 2027. As organizations seek to leverage these innovations, the demand for sophisticated surveillance systems continues to grow.

Increased Private Sector Investment

The private sector in Mexico is increasingly recognizing the value of video surveillance systems, leading to a surge in investments within the video surveillance market. Businesses are adopting these systems not only for security but also for operational efficiency and loss prevention. Retailers, in particular, are leveraging video analytics to understand customer behavior and optimize store layouts. The video surveillance market is witnessing a shift as companies allocate budgets towards advanced surveillance technologies. It is estimated that private sector spending on video surveillance will grow by 10% annually, reflecting a growing awareness of the benefits of these systems. This trend indicates a robust future for the video surveillance market as businesses seek to enhance security and operational insights.

Urbanization and Infrastructure Development

The rapid urbanization and infrastructure development in Mexico are contributing to the expansion of the video surveillance market. As cities grow and new infrastructure projects emerge, the need for effective surveillance systems becomes paramount. Urban areas are increasingly adopting video surveillance solutions to monitor traffic, public transport, and commercial establishments. The video surveillance market is poised to benefit from this trend, as investments in smart city initiatives are expected to rise. By 2026, the market is anticipated to reach $800 million, driven by the demand for integrated surveillance systems that can enhance urban safety and efficiency. This growth reflects a broader recognition of the role of technology in managing urban environments.