Video Surveillance Storage Market Summary

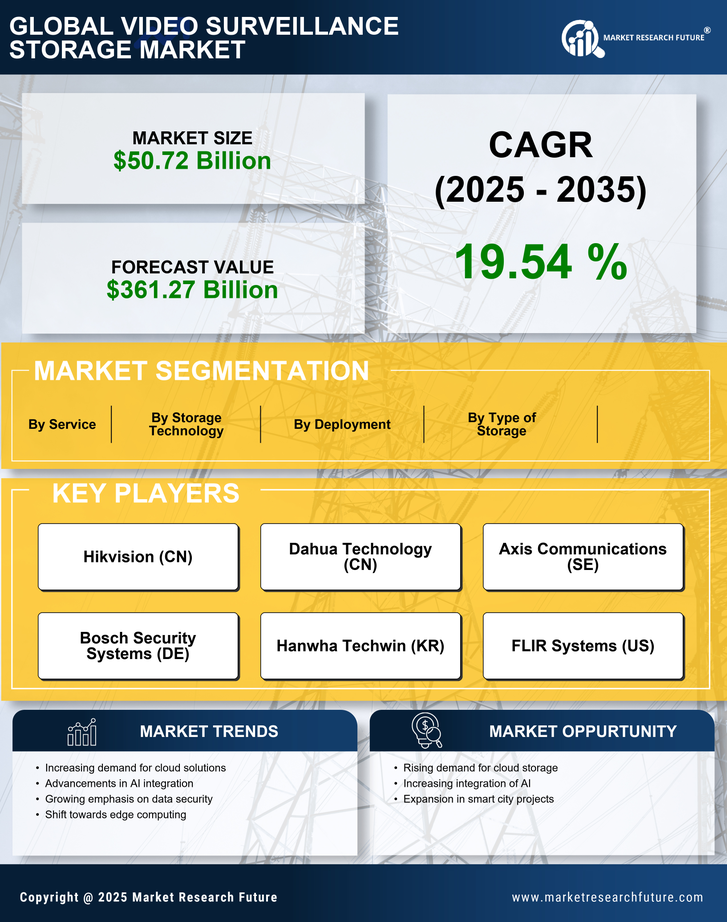

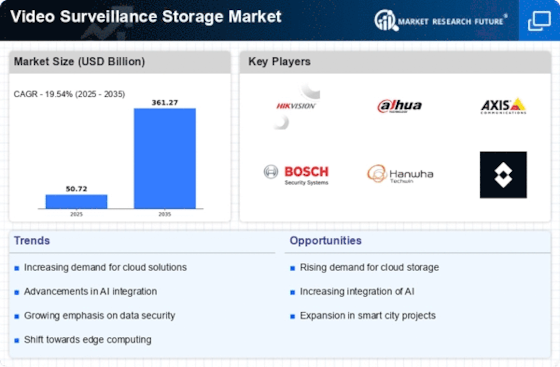

As per Market Research Future analysis, the Video Surveillance Storage Market Size was estimated at 50.72 USD Billion in 2024. The Video Surveillance Storage industry is projected to grow from 60.63 USD Billion in 2025 to 361.27 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 19.54% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Video Surveillance Storage Market is experiencing robust growth driven by technological advancements and increasing security concerns.

- Cloud integration is becoming a prevalent trend, enhancing the flexibility and scalability of storage solutions.

- AI-driven analytics are increasingly utilized to optimize surveillance data management and retrieval processes.

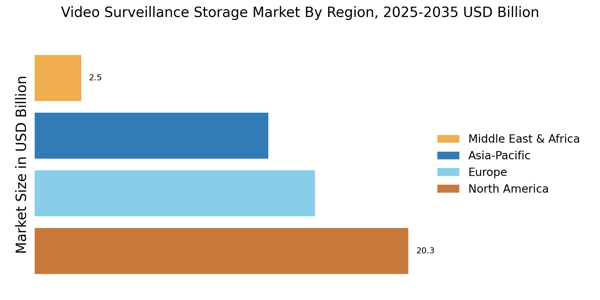

- North America remains the largest market, while Asia-Pacific is emerging as the fastest-growing region in video surveillance storage.

- Rising security concerns and the growing adoption of smart cities are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 50.72 (USD Billion) |

| 2035 Market Size | 361.27 (USD Billion) |

| CAGR (2025 - 2035) | 19.54% |

Major Players

Hikvision (CN), Dahua Technology (CN), Axis Communications (SE), Bosch Security Systems (DE), Hanwha Techwin (KR), FLIR Systems (US), Genetec (CA), Milestone Systems (DK), Honeywell (US)